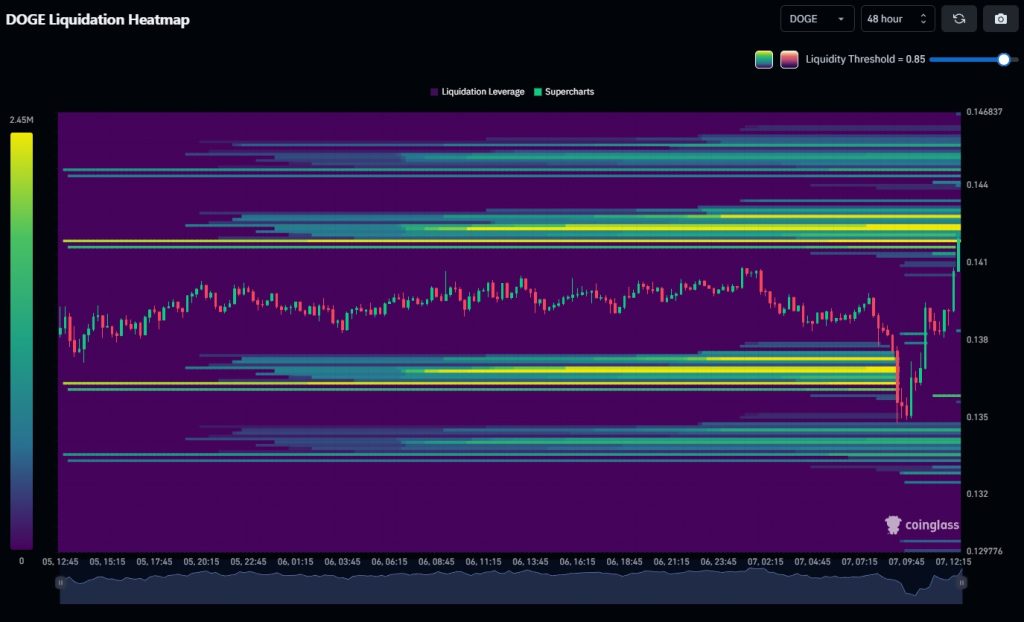

DOGE Jumps as Liquidity Sweep Targets Short Positions Around $0.135-$0.144

⬤ CoinGlass data reveals intense liquidation activity on Dogecoin, with liquidity bands clustering tightly around recent trading levels. Market makers first swept DOGE longs down to roughly $0.135 before flipping direction and pressuring short positions. The heatmap shows significant liquidity concentration above current price levels, marking zones where short liquidations got triggered during the upward move.

⬤ The liquidation heatmap displays leverage pockets on both sides. A massive buildup of long-liquidation liquidity sat below $0.138, matching the earlier downward sweep. Once that liquidity cleared, price quickly pivoted higher toward the $0.141-$0.144 range where clusters of short-liquidation levels were stacked up.

“This behavior reflects typical low-volume Sunday trading dynamics, where limited order flow lets market makers move price through liquidity zones with speed.”

⬤ The pronounced bands near $0.135 show how heavily leveraged long positions concentrated around that level, causing a swift flush when price dipped. The following upward move targeted dense short-liquidation pockets marked by bright zones on the heatmap. These clusters between $0.141 and $0.146 suggest DOGE’s short-term action was driven primarily by liquidity hunting rather than genuine trend development.

⬤ Understanding these liquidity flows explains short-term volatility patterns in DOGE, especially during thin trading periods. The rapid shift from long-liquidation areas to short-liquidation zones signals high sensitivity to leveraged positioning and broader market sentiment.

My Take: Sunday’s DOGE action perfectly demonstrates how thin liquidity turns crypto into a playground for market makers. When trading volume drops, even modest capital can punch through leverage clusters and create dramatic price swings that look bullish but are just mechanical.

Source: KrissPax