BTC Tests Critical Trendline as Bulls Defend Long-Term Support

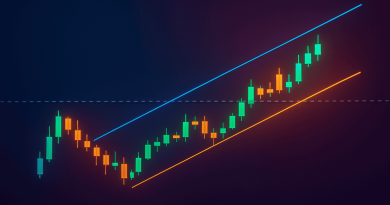

Bitcoin’s two-year uptrend is facing its biggest test yet. The cryptocurrency has returned to its long-standing ascending trendline—a level that’s triggered strong rebounds multiple times since 2023. What happens next could determine whether BTC keeps its bullish momentum or faces its first major breakdown in nearly two years.

The Trendline That Matters Most

According to a chart shared by Ali (Bitcoin/USDT 3D on Binance), Bitcoin has followed a remarkably consistent upward path from under $20,000 in late 2022 to over $110,000 in 2025. Each time BTC has revisited this diagonal trendline, it’s bounced back strongly:

- Mid-2023 (~$25,000): First major retest sparked a sustained rally

- Late 2023 (~$43,000): Second bounce confirmed the support

- Early 2024 (~$70,000): Another successful defense of the line

- Mid-2024 (~$100,000): Most recent test before current price action

- Late October 2025 (~$114,450): BTC is once again sitting just above this critical support

This repeated pattern backs up Ali’ observation: “Everything depends on this trendline.” As long as Bitcoin stays above this line, the bull market structure remains intact.

The trendline isn’t just a chart pattern—it represents a psychological and technical boundary for the entire market. Each touch has brought in fresh buying from long-term holders.

If the support holds: Bitcoin could push toward $125,000–$130,000, continuing its macro uptrend.

If it breaks: A clean close below $100,000 on the 3-day chart would invalidate the pattern and could trigger a deeper pullback toward $88,000 or lower.

Volume remains steady, but momentum indicators are showing signs of exhaustion—suggesting traders should brace for potential volatility in the days ahead.

Market Context

This technical moment comes as macro conditions begin shifting. The Federal Reserve’s hints at easing policy in 2026 have lifted risk assets, including crypto. Bitcoin spot ETF inflows continue supporting institutional demand, creating a solid foundation for price.

Still, profit-taking by short-term holders and slower retail participation have added resistance near $115,000, which explains why BTC is hesitating at this support zone.

The ascending trendline that’s guided Bitcoin’s bull run since 2023 is now its most important support level. If the pattern holds, BTC could be setting up for another major leg up. But if price decisively breaks below, we could see the first serious correction of this entire cycle.