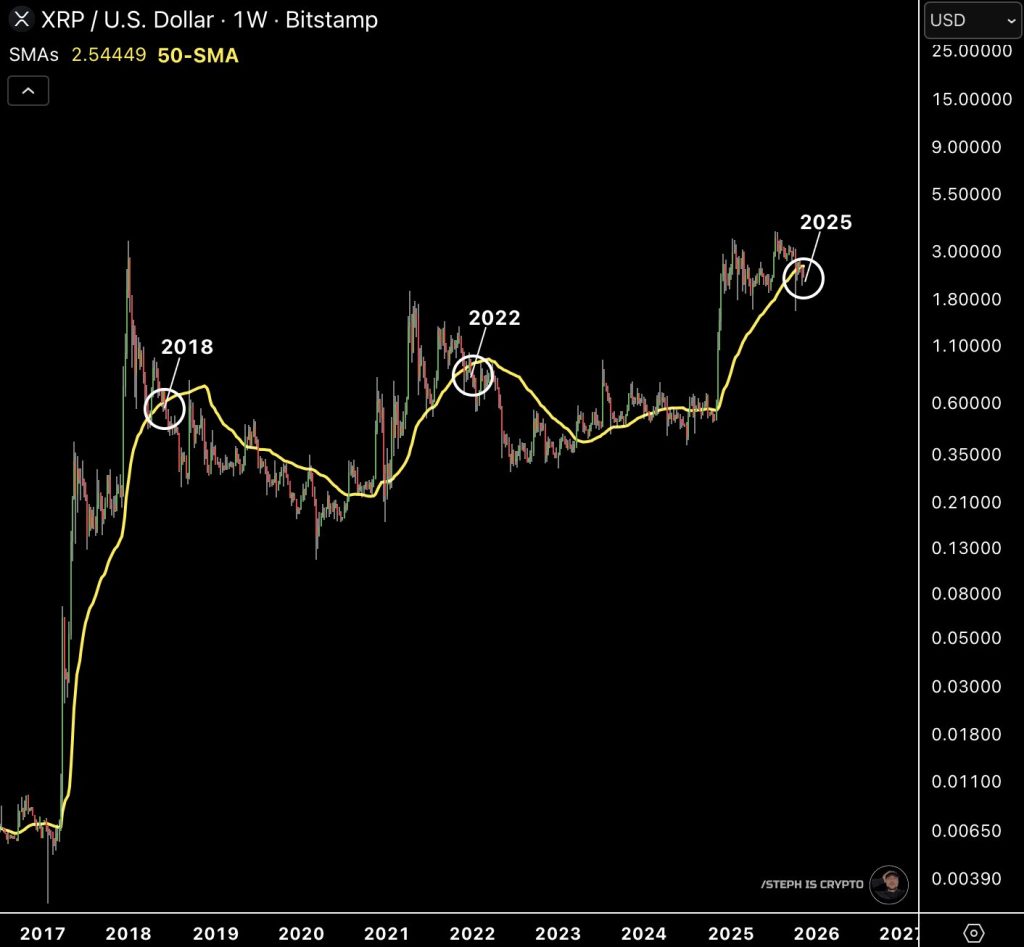

XRP Coin Warning: Major Risk Signal Appears

- XRP has once again touched its 50-week simple moving average (SMA)—a level that historically marked the beginning of significant downturns. The weekly chart shows similar patterns in 2018 and 2022, where XRP failed to hold this critical support line and entered extended bearish phases. This technical vulnerability comes as lawmakers discuss sweeping tax reforms that could further destabilize the digital asset industry.

- Proposed tax changes would introduce new structural burdens on crypto companies, dramatically increasing operational costs and raising immediate risks of bankruptcies, job cuts, and talent flight to more favorable jurisdictions. For XRP investors, this matters because market sentiment tends to weaken sharply when regulatory uncertainty coincides with fragile chart structures.

- Financial analysis projects substantial budget losses if reforms slow industry activity. Reduced corporate profits, trading volumes, and investment flows would decrease government tax revenue. Industry representatives suggest adjusting profit tax rates instead of introducing labor-related structural taxes—an approach they argue would meet fiscal goals without destabilizing blockchain businesses.

- The proposal outlines over a dozen additional amendments related to depreciation rules, reporting requirements, and digital asset classification. These changes could meaningfully reduce tax contributions as companies scale back hiring, pause expansion, or relocate operations. Historically, XRP has reacted strongly during similar periods of heightened policy pressure, and with its price currently retesting the 50-week SMA—just as in 2018 and 2022—the timing amplifies the risk.

- With technical signals weakening and regulatory pressure building, XRP’s near-term trajectory now hinges on whether policymakers revise the proposal—or whether the combined weight of bearish technical structure and tightening tax policy triggers a deeper correction.

Source: STEPH IS CRYPTO