ETH/BTC Eyes Breakout After 101 Days as ETH Targets 0.04 Level

⬤ The ETH/BTC market is heating up as it pushes against a downtrend that’s been in place for over three months. ETH has spent 101 days sliding lower against Bitcoin, but now it’s making another attempt to break through descending resistance. The pair is trading near the 0.033 zone, pressing against what used to be old resistance and is now acting as liquid support.

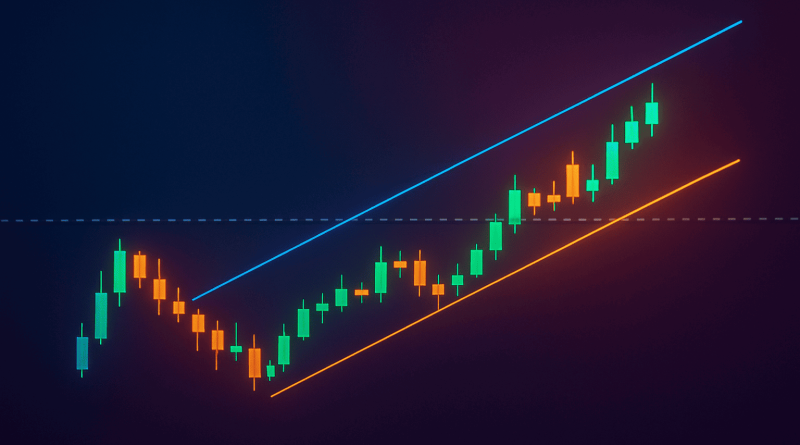

⬤ The chart shows ETH/BTC hammering away at the declining trendline while holding steady above support levels. There’s growing momentum as Ethereum tries to claw back some performance against Bitcoin. If ETHBTC manages to punch through this level with conviction, the rally could push toward the 0.04 mark, which lines up with a key resistance zone that’s been mapped out previously.

⬤ Bitcoin dominance plays a big role here too. If BTC dominance keeps falling, Ethereum’s chances of outperforming Bitcoin go up significantly. “A breakout in progress is noted, reflecting growing momentum as Ethereum tries to regain relative performance,” highlighting the current shift in market dynamics. The chart structure and the ongoing breakout attempt both point to pressure building on the upside for ETH/BTC as it tests the trendline.

⬤ This matters because when ETH/BTC shifts direction, it often triggers broader market rotation. A confirmed breakout toward 0.04 could spark renewed interest across major altcoins and shift overall sentiment in the crypto space. It would signal a meaningful change in relative strength as the market moves into its next phase.

My Take: The 101-day grind is creating serious compression on ETH/BTC, and when trends this long finally break, the moves tend to be sharp. If 0.04 gets reclaimed, it could unlock significant altcoin momentum across the board.

Source: CRYPTOWZRD