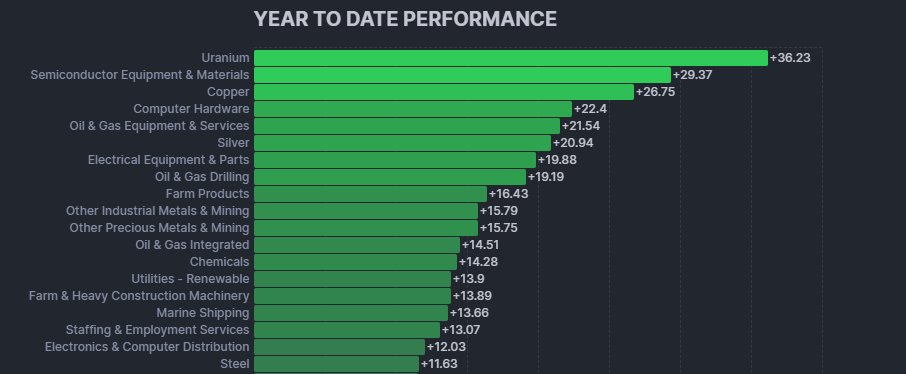

Uranium Up 36%, Semiconductor Equipment Gains 29% as Commodities Lead 2026 YTD Performance

Uranium, semiconductor equipment, and copper have emerged as the strongest-performing sectors so far in 2026, significantly outperforming the broader market, according to year-to-date sector performance data. The gains point to rising demand for physical resources and long-cycle industrial investment rather than short-term speculative flows.

Uranium leads all sectors with gains of approximately 36% year to date, followed by semiconductor equipment at around 29% and copper-related exposure up roughly 27%.

Key Performance Leaders:

1. Uranium

Uranium is the top-performing sector of 2026 so far, posting gains of about 36% year to date. The rally reflects tightening supply dynamics in nuclear fuel markets alongside growing long-term demand tied to energy security and power generation needs.

The persistence of uranium’s advance suggests sustained pressure across the nuclear fuel supply chain rather than temporary speculative positioning.

2. Semiconductor Equipment

Semiconductor equipment and materials have gained roughly 29% year to date, ranking second among sector performers. The strength reflects continued capital investment in chip manufacturing capacity, driven by AI infrastructure expansion, industrial automation, and reshoring initiatives.

Unlike consumer-facing technology, semiconductor equipment is closely linked to long-cycle capital spending, reinforcing its role as a structurally supported segment within global industrial investment trends.

3. Copper and Industrial Metals

Copper-related exposure is up approximately 27% year to date, placing it among the top three performing sectors in 2026 so far. Demand for copper continues to rise alongside electrification projects, grid expansion, and industrial construction, while supply constraints remain a persistent challenge.

The parallel strength in copper and uranium highlights pressure in physical commodity markets rather than sentiment-driven market rotations.

Broader Sector Strength

Strength extends beyond the top three sectors. Computer hardware is up around 22% year to date, while oil and gas equipment and services have gained roughly 21%. Silver, electrical equipment, and oil and gas drilling are also posting solid double-digit returns.

Further down the list, industrial metals, precious metals, chemicals, and renewable utilities continue to show positive year-to-date performance, reinforcing the commodity- and industry-heavy nature of current market leadership.

Why It Matters

What stands out is not only the size of the gains, but their concentration. Market leadership in 2026 is tightly clustered around commodities, industrial inputs, and hardware-linked sectors.

When uranium, copper, and semiconductor equipment advance simultaneously, it typically signals deeper supply-demand imbalances rather than a broad risk-on environment. The pattern suggests markets are responding to real-world constraints, including limited resource availability, rising infrastructure investment, and extended industrial planning cycles.

Outlook

As 2026 progresses, investors will be watching whether this leadership cluster broadens or intensifies. Continued strength into the second quarter could reinforce a sustained rotation toward real assets and capital-intensive sectors.

For now, market data point to an environment driven less by sentiment and more by structural demand and supply-side pressure across commodities and industrial value chains.