Uranium Faces 32% Supply Deficit by 2045 as Nuclear Demand Surges — Goldman Sachs

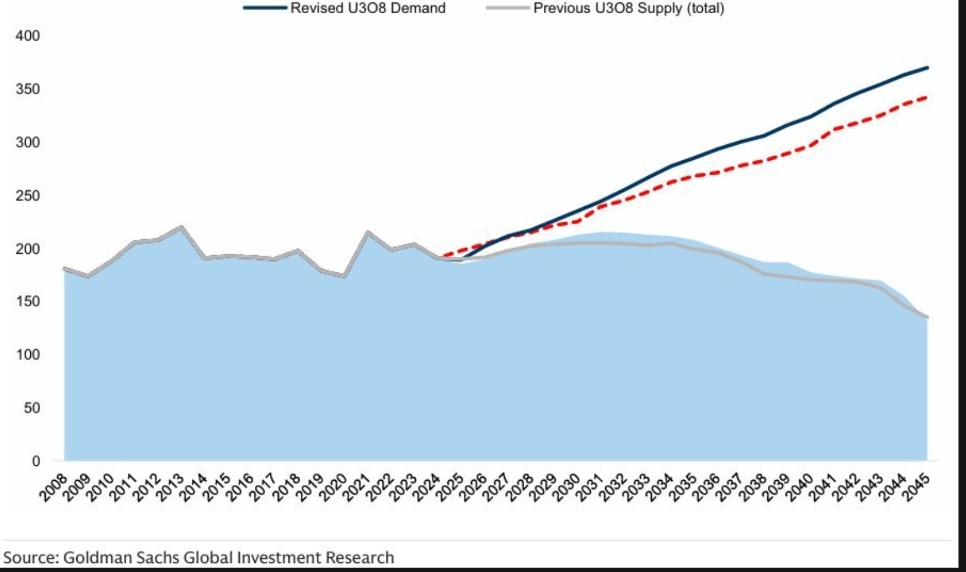

Uranium markets are on track for a deep, long-term supply shortage, according to a new report from Goldman Sachs Global Investment Research. The bank estimates that global uranium supply could fall 32% short of reactor demand by 2045, as nuclear power expansion accelerates faster than mining output can respond.

The forecast is driven by a wave of new nuclear reactor construction, reactor restarts, and reactor life extensions, particularly in the United States, which are lifting long-term uranium consumption. At the same time, uranium production is expected to remain constrained, creating a structural imbalance in the market.

According to Goldman Sachs, this widening gap is not a short-term cyclical issue but a multi-decade supply-demand mismatch that could reshape uranium pricing, investment incentives, and the strategic role of nuclear fuel in global energy policy.

Nuclear Expansion Drives Uranium Demand

Goldman Sachs highlights a significant expansion in nuclear power capacity as the primary driver of future uranium demand. In the United States alone, plans between 2025 and 2045 include:

- Construction of 20 new nuclear reactors

- Restarting three reactors that were previously taken offline

- Completion of two reactors already under construction

- Extending the operational life of existing reactors by an average of five years

These developments steadily push uranium demand higher, with the sharpest increases expected during the 2030s as new capacity comes online and existing reactors operate longer than initially planned.

Uranium Supply Struggles to Keep Pace

While demand accelerates, uranium supply is expected to lag significantly. Goldman Sachs projects that global uranium production will remain roughly flat in the near term, before entering a gradual decline after the mid-2030s.

This divergence between rising reactor requirements and constrained mining output forms the basis of the bank’s projected 32% supply deficit by 2045. According to Goldman Sachs Global Investment Research, the gap underscores how difficult it is to scale uranium production quickly enough to meet future nuclear fuel needs.

Why This Matters

The projected uranium deficit has implications far beyond pricing. Nuclear power plays a central role in energy security, decarbonization strategies, and grid stability, particularly as countries seek reliable low-carbon electricity sources.

With reactor construction, restarts, and life extensions accelerating faster than mining capacity, uranium is emerging as a strategically constrained commodity. Goldman Sachs notes that this imbalance reflects a long-term structural shift rather than a temporary market fluctuation.

Outlook Through 2045

Goldman Sachs’ analysis suggests that uranium market tightness could persist for decades. Without substantial new investment in uranium mining and fuel-cycle infrastructure, the gap between reactor demand and supply is likely to widen further.

Such conditions could increase market volatility, influence government energy policies, and reinforce uranium’s growing strategic importance within the global energy transition.

Sources:

- Goldman Sachs Global Investment Research

- Twitter post by Lukas Ekwueme