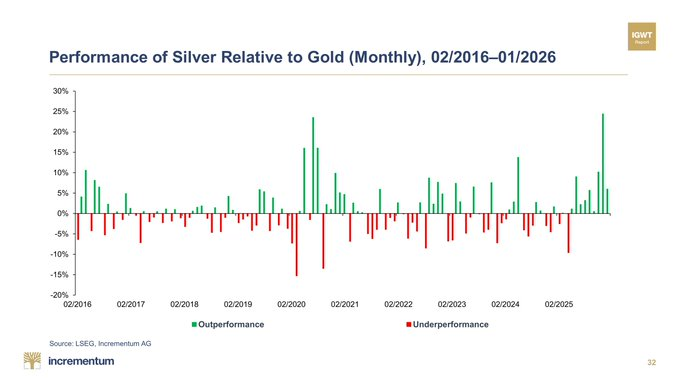

Silver Outshines Gold for 9 Straight Months

Silver has now beaten gold for nine straight months, marking one of the most persistent stretches of outperformance in the past decade. This represents “9 straight months of silver outshining gold.” Even during January’s sharp selloff across commodities, silver still outperformed gold by more than five percentage points.

The “Performance of Silver Relative to Gold (Monthly), 02/2016–01/2026” data highlights just how unusual this run has been. Historically, leadership between the two metals rotated frequently. This time, the trend has shown rare durability.

Monthly Performance Breakdown

December’s Historic Move

December stood out as the strongest relative gain for silver versus gold in over a decade. While silver has experienced sharp spikes before, particularly during mid 2020 volatility, those moves lacked long term follow through. The current streak reflects sustained leadership rather than a short lived surge.

The magnitude of December’s outperformance suggests that capital flows into silver have accelerated, potentially reflecting institutional repositioning rather than retail driven momentum alone.

January Selloff Fails to Break the Trend

Even during January’s broad market weakness, silver maintained its edge. This resilience under pressure reinforces the idea that underlying structural forces are supporting price action.

In previous cycles, macro headwinds often reversed silver’s relative strength quickly. The current environment shows a different pattern, where silver continues to outperform despite volatility across commodities.

Structural Drivers Behind Silver’s Strength

Supply Deficits Tighten the Market

One of the most important fundamental drivers is the ongoing supply imbalance. As detailed in Silver’s supply deficit extends into its fifth year, structural shortages now total roughly 800 million ounces over multiple years. This persistent deficit reinforces tightening inventories and limits downside flexibility in the market.

With supply constraints entering a fifth consecutive year, the silver market is facing conditions that differ meaningfully from earlier cycles when mine output could respond more quickly to higher prices.

Technical Structure and Liquidity Dynamics

From a technical standpoint, silver recently underwent a liquidity sweep before stabilizing. In Silver consolidates after liquidity sweep, price action shows the market digesting prior volatility while defending key support levels.

Additionally, Silver consolidation between key levels highlights how the metal is compressing within a defined range as traders await a breakout. This technical compression often precedes larger directional moves, particularly when supported by strong fundamentals.

Why Silver Is Diverging from Gold

Extended periods of silver outperformance typically reflect a combination of shifting industrial demand, speculative positioning changes, and evolving macro expectations around inflation and monetary policy.

Unlike gold, which primarily serves as a monetary hedge, silver has a dual identity as both a precious and industrial metal. Rising demand from technology, renewable energy, and manufacturing sectors adds another layer of structural support.

The current nine month streak suggests that investors are increasingly recognizing silver’s scarcity premium and differentiated demand profile.

Outlook for 2026

Whether this momentum continues through the rest of 2026 will depend on several factors:

- Ongoing supply constraints

- Industrial demand growth

- Inflation and interest rate trends

- Broader commodity market conditions

If deficits persist and demand remains firm, silver could maintain its relative advantage over gold. However, sharp macro shifts could still alter the balance between the two metals.

For now, silver’s consistent leadership signals a meaningful shift in the precious metals landscape rather than a temporary anomaly.

My Take

This nine month run is more than statistical noise. The combination of structural supply deficits, strengthening industrial demand, and improving technical structure creates a backdrop not seen in years. December’s strongest relative performance in a decade suggests that larger market participants may be repricing silver’s long term value relative to gold.

Source: Twitter Post by In Gold We Trust