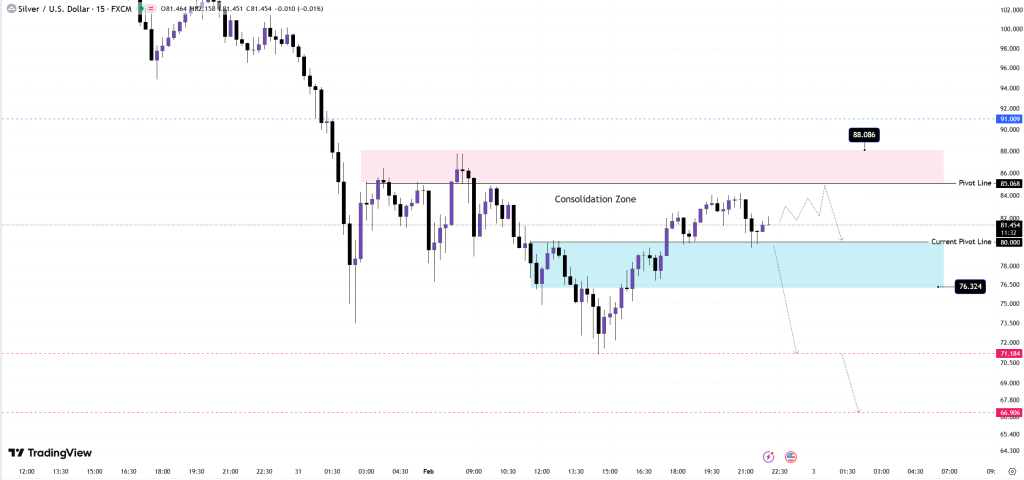

Silver Consolidates Between $80.13 and $85.40 as Markets Await Breakout

Silver prices are currently locked in a narrow consolidation range as traders wait for a decisive move. After a sharp selloff, price action has shifted into sideways movement, with silver oscillating between clearly defined technical levels. This consolidation phase reflects growing uncertainty in the precious metals market following recent volatility.

Key Market Levels and Technical Signals

Short-Term Price Structure

On the 15-minute chart, silver continues to test both the lower and upper boundaries of its range without producing a confirmed breakout. The repeated reactions at these levels highlight a market in balance, where neither buyers nor sellers have gained control.

- Support: $80.13

- Resistance: $85.40

The longer silver remains trapped within this zone, the more significant the eventual breakout is likely to be.

Downside Scenario: Support at Risk

If silver breaks below $80.13, traders should watch for confirmation via a 15-minute or 1-hour candle close beneath this level. A confirmed breakdown would signal renewed bearish momentum.

Potential downside targets include:

- $76.89 as the first support

- $71.38 as a deeper downside level

- $66.70 in a worst-case scenario, based on historical support zones

A sustained move below $80.13 could quickly accelerate losses as downside pressure builds.

Upside Scenario: Breakout Above Resistance

For bullish momentum to return, silver must break above $85.40 and hold above that level. Repeated failures near this resistance underline its importance.

If a breakout is confirmed:

- $87.81 becomes the next upside target

- $91.00 marks a key resistance area where price previously stalled

A successful move above resistance would signal a shift away from consolidation and toward a recovery phase.

Why This Matters

This tight consolidation reflects broader uncertainty across precious metals markets. Compression between strong support and resistance levels often precedes large directional moves. As volatility contracts, the probability of a sharp breakout increases, making silver particularly sensitive to price behavior around these key levels.

Outlook for the Coming Sessions

Silver’s current range is unlikely to persist indefinitely. The longer price remains compressed between $80.13 and $85.40, the stronger the eventual move may be. A breakdown below support could trigger rapid downside acceleration, while a confirmed hold and rebound could set up a meaningful recovery rally.

Market participants should closely monitor how silver reacts at these levels, as they will likely define the next trend.

Source: Mary