Silver Supply Deficit Extends into Fifth Year with 800 Million Ounce Shortfall

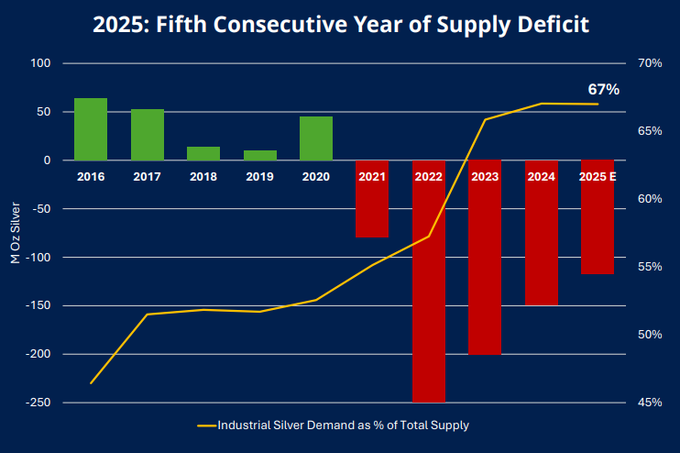

The global silver market is heading into its fifth straight year of supply deficits, with cumulative shortfalls now totaling roughly 800 million ounces. This volume is nearly equivalent to an entire year of global silver mine production. The continued imbalance between supply and demand highlights growing structural pressure within the silver market.

Industrial demand has expanded significantly and now accounts for approximately 67 percent of total silver supply. This shift in demand composition has materially tightened market fundamentals and contributed to persistent structural deficits.

Key Market Developments

Five-Year Deficit Pattern

Silver has remained in deficit every year since 2021, with projections indicating the imbalance will continue through 2025. The market has not returned to surplus since 2019.

This multi-year pattern reflects ongoing supply constraints combined with sustained demand growth. Over five years, repeated annual shortfalls have steadily reduced available inventories, removing significant quantities of physical metal from circulation. The result is an increasingly tight physical market environment.

The cumulative shortfall over the past five years now totals approximately 800 million ounces, an amount roughly equivalent to an entire year of global silver mine production.

Industrial Demand Surge

The primary driver behind this prolonged deficit cycle is the surge in industrial consumption. Industrial demand now represents about 67 percent of total silver supply, up from notably lower levels earlier in the 2010s.

Silver plays a critical role in electronics manufacturing, photovoltaic solar panels, and electrical conductors. Recent technical price behavior reflects this tightening structure. For example, in Silver consolidates after 1.20 liquidity sweep market structure showed how liquidity dynamics interact with broader supply conditions.

Similarly, short-term pullbacks such as Silver pulls back after rejection near 88 highlight how resistance levels and technical zones develop within a fundamentally tight market.

Why This Matters

Persistent supply deficits have increasingly influenced price discovery in silver markets. Physical imbalances shape long-term price structures, even when futures positioning fluctuates.

Episodes of volatility such as Silver crashes over 10 amid classic supply response demonstrate how sharp price movements can occur within structurally constrained markets, especially when rapid rallies trigger supply responses or profit-taking.

As cumulative deficits remove metal from available inventories, fundamental tightness becomes a stronger driver of valuation. While trading sentiment and macroeconomic conditions may amplify short-term volatility, the underlying physical shortage remains a consistent structural factor.

Long-Term Outlook

With deficits extending into a fifth consecutive year, the silver market faces significant challenges in restoring balance. The 800 million ounce cumulative shortfall represents nearly one full year of global mine production.

Unless mine supply expands meaningfully or industrial demand slows substantially, structural tightness may continue to support longer-term pricing dynamics.