Silver Finds Support at Fibonacci Level, Eyes Month-End Rally

After weeks of sliding toward the $45.8 zone, silver is finally showing some life. The bounce lines up nicely with key technical support levels—including a Fibonacci extension and an EMA crossover—both of which often signal short-term reversals. Momentum indicators are looking healthier too, suggesting this pullback was just a breather rather than a trend change. With buying interest picking up as the month wraps up, silver might be setting itself up for a solid recovery run.

Chart Analysis: Rebound Confirmed by Multiple Technical Signals

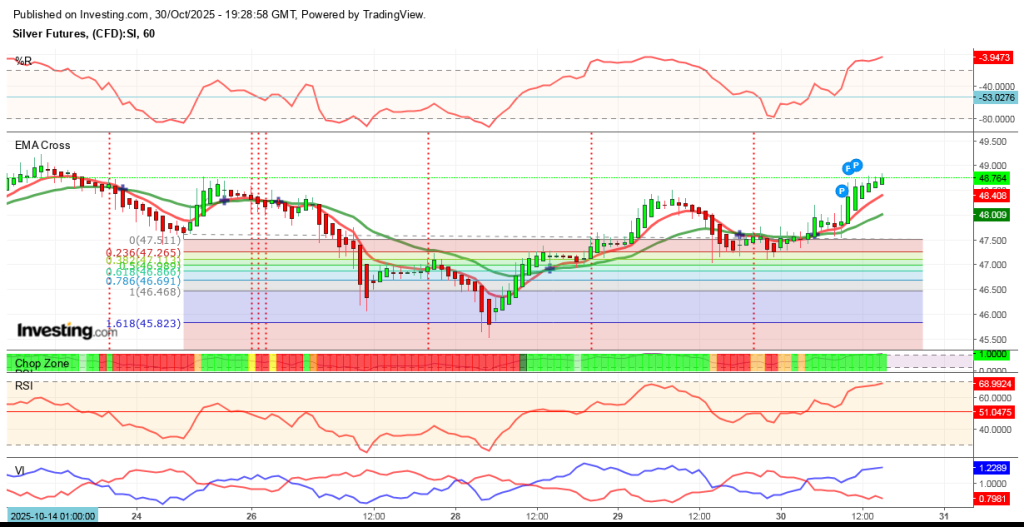

Analyst Tofiq Fazlullah CIA (USA),CMA (UK ) suggests the metal may have bottomed out on October 28 and could be gearing up for a month-end rally. The chart shows silver rebounding cleanly from the 1.618 Fibonacci projection at $45.82, where it found its footing and started building higher lows. Since then, it’s climbed past several Fibonacci zones and is now eyeing the $48.7–$49.0 resistance area. Here’s what stands out:

- Bottom Formation: Confirmed near $45.8, right at the Fibonacci 1.618 level

- Support Zone: $46.0–$47.3 is providing a solid base for the current bounce

- Resistance Ahead: $48.7–$49.0 is the next hurdle, with some candle rejections already visible there

- EMA Crossover: A bullish cross confirms the shift from bearish to bullish momentum

- RSI at 69: Strong buying pressure, though nearing overbought territory—watch for possible consolidation

- Volatility Indicators: The Chop Zone has gone green, showing clear directional movement, while the VI (+) crossing above VI (–) signals bullish energy

All of this backs up the idea that silver bottomed out last week and is now building momentum for a potential push above $49 in the next few sessions.

Market Context & Outlook

This isn’t just a technical story. The recent weakness in the U.S. dollar and talk of future rate cuts have made precious metals more attractive. Add in the seasonal uptick in physical and industrial demand that typically hits in late Q4, and you’ve got a decent setup for silver heading into November.

Right now, all eyes are on that $49 resistance level. A clean break above it could open the door to $50–$51, where the next Fibonacci extension sits. If silver stumbles and falls below $48, it might revisit support at $47.3—but as long as $46 holds, the overall picture stays bullish.