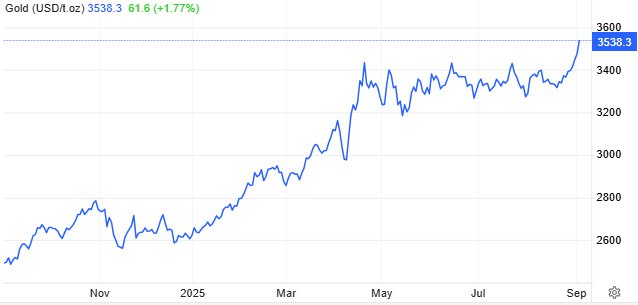

Gold (XAU) Price Hits Record $3,538 as Fed Rate Cut Bets and Geopolitical Risks Drive Rally

Gold has been on an impressive tear lately, breaking through previous resistance levels and setting new records that have caught the attention of investors worldwide. The precious metal’s latest surge reflects a perfect storm of factors that typically drive investors toward safe-haven assets, creating a compelling case for continued strength in the gold market.

Gold (XAU) Price Breaks New Records

Gold’s bullish run picked up serious steam this week, jumping +1.77% in just one trading session to hit $3,538 per ounce. This new 2025 record highlights gold’s position as the go-to safe-haven asset when uncertainty creeps into global markets.

Market analyst @nihalzenginn pointed out that the mix of Federal Reserve policy shifts and geopolitical tensions continues to drive strong demand, pushing gold into territory we’ve never seen before.

The rally is largely fueled by growing expectations that the U.S. Federal Reserve will cut interest rates sooner than many initially thought. Investors are betting that slower economic growth and cooling inflation will push the Fed toward a more accommodating policy stance.

When interest rates drop, it typically weakens the dollar and lowers bond yields, making gold more appealing since it doesn’t pay interest but holds its value well during uncertain times.

Geopolitical Risks Add to Gold Momentum

Beyond central bank policy, rising tensions in Eastern Europe and the Middle East are giving gold an extra boost. Investors are flocking to gold as protection against currency swings, trade disruptions, and general market volatility.

The combination of monetary policy expectations and global uncertainty is creating the perfect environment for gold’s historic run.

Now that gold has broken through the $3,500 barrier, analysts are eyeing $3,600 as the next major target. The technical setup looks strong, and buying pressure from both big institutions and central banks suggests this rally might have more room to run.

If the Fed confirms rate cuts in upcoming meetings, we could see gold push even higher than $3,600. But if rate cuts get delayed, gold might take a breather before continuing its climb.