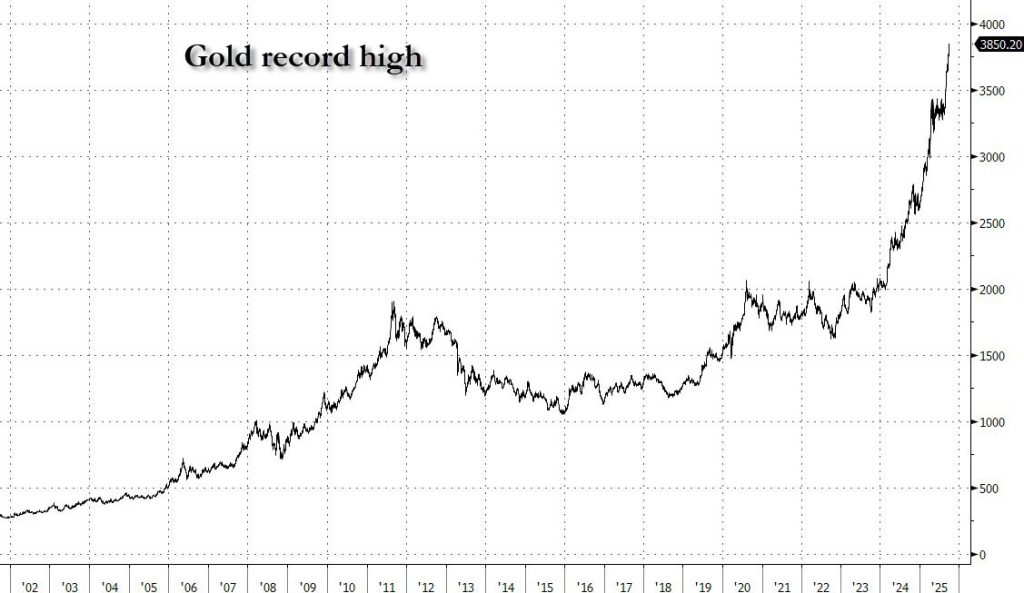

Gold Hits Record High Above $3,850 Amid Global Uncertainty

Gold has broken into uncharted territory, climbing above $3,850 per ounce for the first time ever. This dramatic rally isn’t just about hitting a new number—it reflects deepening anxiety across global markets. Investors are turning to gold as traditional safe havens feel increasingly shaky, and the metal’s historic surge suggests that something bigger may be brewing beneath the surface.

As Brian Rose, Founder & Host of London Real noted, “What’s gold picking up on? Rising inflation? Geopolitical tensions? Systemic cracks in the global order? Whatever it is, this isn’t business as usual.” The move signals that markets are bracing for turbulence that goes well beyond typical volatility.

What the Charts Are Showing

The long-term gold chart tells a clear story. After a steady climb through the 2000s that peaked during the 2011 debt crisis, gold spent years consolidating between $1,100 and $1,400. The $2,000 level became a psychological barrier, tested repeatedly since 2020 before finally giving way. Over the past year, gold has rocketed from around $2,500 to $3,850—one of the sharpest rallies in decades. This isn’t a slow grind higher. It’s a vertical move that screams extraordinary demand.

Why This Is Happening

Several forces are converging to drive gold to record levels. Inflation has proven stubborn despite aggressive rate hikes, making gold attractive as a store of value. Geopolitical flashpoints around the world are multiplying, pushing nervous capital into safe assets. There’s growing unease about sovereign debt levels, fragile banking systems, and the long-term viability of the dollar-dominated global order. Meanwhile, central banks are facing real questions about whether they can actually control inflation and maintain stability—which only strengthens the case for assets that exist outside the traditional system.