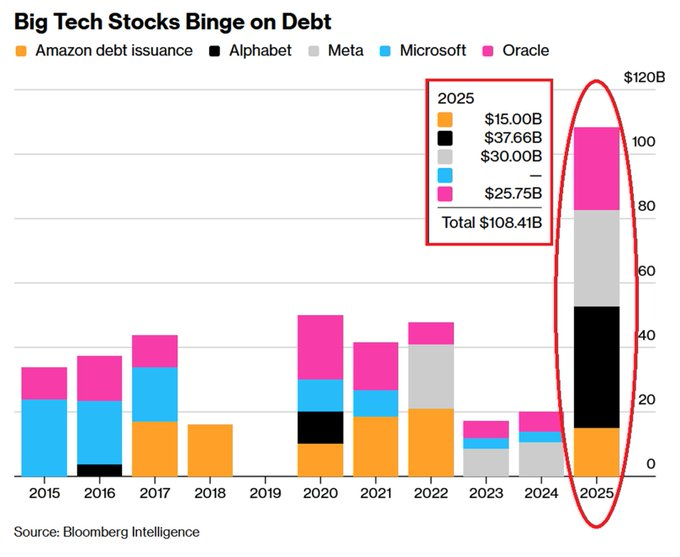

Big Tech Debt Issuance Hits Record $108B in 2025

- Major U.S. tech companies ramped up borrowing in 2025, pushing bond issuance to $108.41 billion—an all-time high. Recent data shows Amazon, Alphabet, Meta, Microsoft, and Oracle leading the charge, with debt levels dramatically outpacing anything seen in the past decade. This surge reflects the industry’s push to build out AI infrastructure and expand data-center capacity.

- Meta topped the list with $37.66 billion in new debt, followed by Microsoft at $30 billion, Oracle at $25.75 billion, and Amazon at $15 billion. Combined, these issuances hit $108.41 billion—more than five times what companies borrowed in either 2023 or 2024. Companies are pouring capital into compute-intensive workloads and chip development.

- The figures don’t include off-balance-sheet borrowing through Special Purpose Vehicles, which is also climbing. The jump in 2025 stands out sharply compared to previous years, showing just how capital-intensive the AI race has become. Cloud platforms, semiconductor projects, and large-scale AI model training are driving the spending spree.

- This borrowing boom signals that tech giants see AI investment as a long-term priority worth massive upfront costs. The aggressive pace suggests companies are positioning themselves for dominance in the next phase of technology competition, with sustained spending on infrastructure and R&D expected to continue.

My Take: Big Tech’s record debt binge shows they’re betting everything on AI leadership. With $108B borrowed in just one year, these companies are essentially saying the future belongs to whoever builds the biggest infrastructure first—and they’re willing to leverage their balance sheets to win.

Source: Global Markets Investor