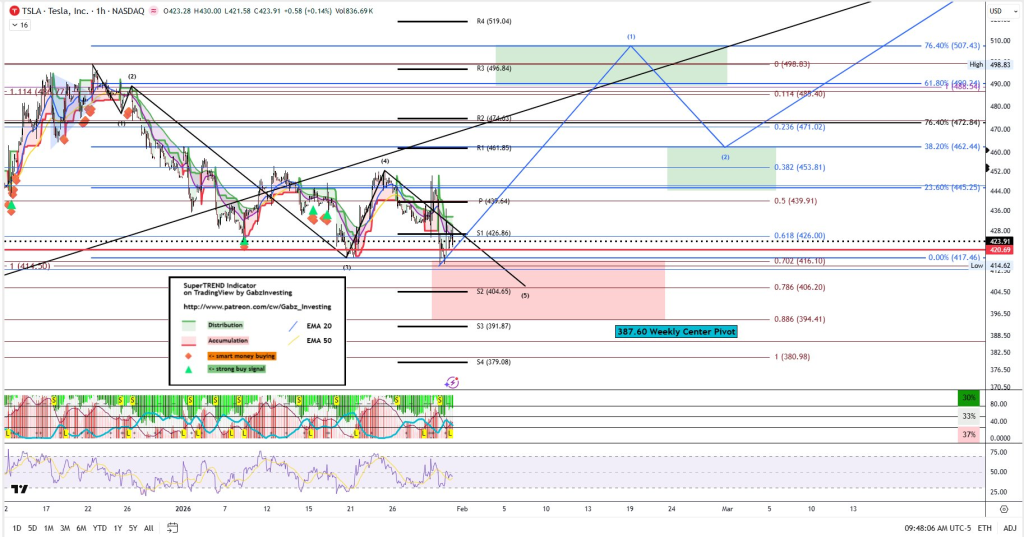

TSLA Stock Holds $426–$439 Pivot Levels Heading Into February

Tesla shares (TSLA) held firm near the $426–$439 pivot zone during Friday’s session, signaling short-term stability after a week marked by selling pressure. Despite broader market caution, the stock managed to avoid a breakdown toward lower weekly support levels, keeping key technical structures intact heading into February.

From a technical perspective, TSLA remained above several closely watched weekly and intraday pivot levels, areas commonly monitored by short-term traders and systematic strategies. The ability to defend these zones suggests that buyers stepped in at predefined support levels rather than allowing downside momentum to accelerate.

This setup is particularly relevant as February approaches — a period that often brings volatility tied to monthly repositioning and broader macro-driven sentiment shifts. How Tesla trades around the $426–$439 range is likely to play a key role in determining near-term directional bias.

The analysis is based on technical market levels and trader commentary highlighted in a recent post by Tracker.

Weekly and Intraday Pivot Zones

During Friday’s session, TSLA traded near several important pivot levels that shaped short-term price action. The stock held above the weekly center pivot around $387.60, a level previously identified as a potential downside risk. By staying above this zone, Tesla avoided a broader technical breakdown.

On an intraday basis, price action gravitated toward the 1-hour S1 pivot near $426.86 and the center pivot around $439.64. These levels acted as near-term anchors, with multiple technical indicators aligning in this range and helping absorb selling pressure into the weekly close.

Price Action and Market Behavior

Rather than trending decisively in either direction, TSLA traded within a compressed range between support and resistance. Market analysis suggests the stock avoided a late-session test of lower weekly levels, reflecting a balance between caution and short-term stability.

Chart patterns indicate that Tesla remained confined within its established technical range, failing to break convincingly above resistance while also avoiding deeper downside territory. This behavior points to a market waiting for clearer directional catalysts.

Why This Matters for TSLA

Holding above the $426–$439 zone indicates that buyers were active at key technical levels, limiting downside momentum. The lack of aggressive selling pressure supports the view that lower weekly support levels remain intact for now.

As a result, TSLA remains highly sensitive to reactions around these pivot zones, particularly during periods of broader market uncertainty when technical levels tend to guide short-term positioning.

Outlook Heading Into February

Looking ahead, pivot levels and sentiment zones are likely to continue guiding Tesla’s near-term price action. A brief downside probe toward lower support early in February remains possible, a pattern often observed during monthly transitions.

However, whether TSLA resumes a move toward higher resistance or revisits lower caution zones will depend on how price reacts around the $426–$439 range in the coming sessions.

Analyst Take

Tesla’s ability to hold above the $426–$439 pivot area heading into February suggests that buyers remain active at key technical levels. While short-term volatility around the monthly transition cannot be ruled out, this zone remains critical in determining whether bulls or bears gain control next.