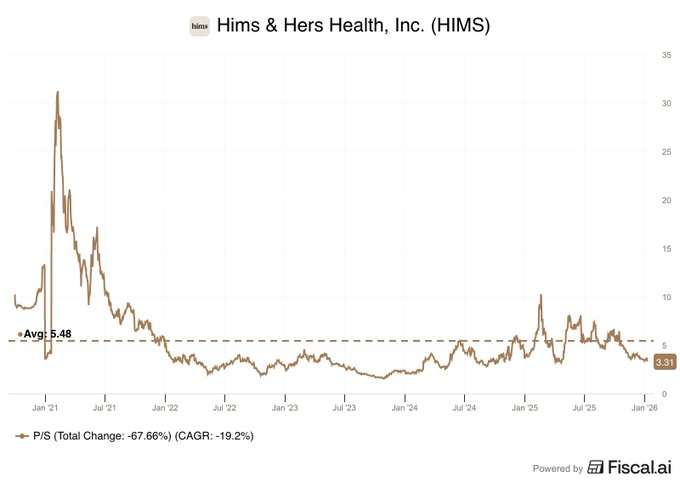

HIMS Stock Trades 60% Below Historical Valuation at 3.31x P/S Ratio

Hims & Hers Health (HIMS) is trading at a price-to-sales ratio of just 3.31x, nearly 60% below its historical average valuation, according to current market data. The compression places the digital healthcare company well below its long-term P/S multiple of around 5.5x, despite continued revenue growth and platform expansion.

The sharp valuation gap reflects a shift in investor sentiment, not a deterioration in Hims & Hers’ underlying business model. Markets have increasingly narrowed their focus to the company’s exposure to GLP-1 weight-loss treatments, overlooking its broader multi-vertical healthcare platform.

Hims & Hers operates across telemedicine, consumer wellness, and digital healthcare infrastructure, positioning itself as more than a single-product growth story. The current multiple suggests investors are reassessing digital health valuations across the sector rather than reacting to company-specific weaknesses.

Market participants note that such sentiment-driven re-ratings often emerge during periods of tighter capital discipline, especially among platform-oriented healthcare companies.

Valuation data referenced from public market pricing and investor commentary shared by Daniel on X (Twitter).

Valuation Snapshot

Current Valuation Metrics

- Price-to-sales ratio: 3.31x

- Historical average P/S: ~5.5x

- Decline from peak valuation: over 60%

Since going public, HIMS initially benefited from elevated growth valuations. However, beginning in 2021, the company’s P/S ratio began a steady contraction, continuing through 2022 and 2023 before stabilizing at today’s depressed levels. This marks a significant reassessment by investors.

Market Interpretation

The valuation reset appears driven more by perception than performance. Market analysis suggests investors are increasingly viewing HIMS through a narrow lens, focusing primarily on its exposure to GLP-1 weight-loss treatments rather than its broader healthcare platform.

Business Model Beyond GLP-1

While GLP-1 therapies have become a focal point for the stock, they represent only one component of Hims & Hers’ strategy. The company is building a personalized digital healthcare platform spanning multiple verticals, including telemedicine, consumer wellness, and long-term care delivery.

The current valuation does not reflect product failures or structural weakness. Instead, it highlights a shift in expectations as investors grow more selective about growth narratives in digital health.

Why This Matters for Digital Health

Hims & Hers operates at the intersection of:

- Telemedicine

- Consumer healthcare

- Digital health infrastructure

The stock trading well below historical norms underscores how quickly sentiment can change for platform-oriented healthcare companies. It also signals a broader repricing across the digital health sector, where markets are demanding clearer paths to sustainable growth.

Outlook and Market Implications

If market perception continues to focus narrowly on GLP-1 exposure, valuation multiples may remain compressed in the short term. However, renewed recognition of HIMS as a diversified healthcare platform could act as a catalyst for re-rating, especially as the company expands across additional verticals.

My Take

HIMS trading at a 60% discount to its historical valuation represents a compelling setup for investors who believe in the long-term platform thesis. The market’s fixation on GLP-1 exposure risks overlooking the broader healthcare ecosystem the company is building. Historically, some of the most attractive entry points emerge when sentiment becomes overly one-sided.