PLTR Institutional Ownership Climbs 6% as Palantir Attracts $400M+ in Major Fund Inflows

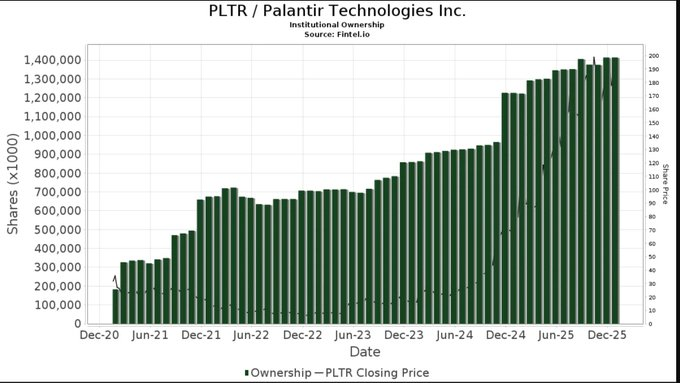

Institutional ownership of Palantir Technologies continued to rise throughout 2025, increasing by roughly 6% as major asset managers expanded their positions. The trend reflects growing confidence in Palantir’s AI-focused business model, with more than $400 million in fresh institutional capital flowing into PLTR during the year.

Institutional Accumulation Accelerates

Data shows that institutional shareholdings in Palantir have climbed steadily since 2021, with momentum accelerating sharply in late 2024 and throughout 2025. This increase coincided with a strong rally in PLTR’s share price and growing interest in AI infrastructure companies.

Rather than holding existing positions, many large funds actively added shares in recent quarters, signaling conviction rather than passive exposure.

Major Asset Managers Increase Stakes

Several of the world’s largest investment firms led the accumulation:

- BlackRock increased its Palantir stake by 6.36% in Q3 2025, adding approximately 11.3 million shares and bringing its total holdings to about 188.5 million shares.

- Vanguard Group, already Palantir’s largest institutional holder, added 8.2 million shares, a 3.97% increase, raising its total position to roughly 213.9 million shares.

- State Street and Geode Capital Management both recorded increases of more than 7% during the same period.

- Invesco and KLP Kapitalforvaltning also joined the buying wave, with KLP increasing its holdings by 5.3% in Q3 alone.

These moves placed PLTR among the top stocks for institutional fund inflows in 2025.

Why Growing Institutional Demand Is a Bullish Signal

Sustained institutional accumulation plays a critical role in shaping a stock’s long-term behavior. When large funds consistently add shares quarter after quarter, it typically:

- Improves liquidity

- Supports price stability

- Strengthens overall market confidence

For Palantir, rising institutional ownership reinforces the perception that its AI-driven platform has transitioned from a speculative growth story into a core long-term holding for major funds.

My Take

If current trends continue into 2026, Palantir could see institutional ownership climb even further as AI infrastructure spending expands. Future inflows will likely depend on:

- Continued revenue growth tied to AI adoption

- Execution on government and commercial contracts

- Broader sentiment toward AI-focused technology stocks

A sustained presence from long-term capital may reduce volatility while supporting higher valuation multiples over time.

Sources:

- Twitter post by Danny Cheng

- Twitter post by John Kemp