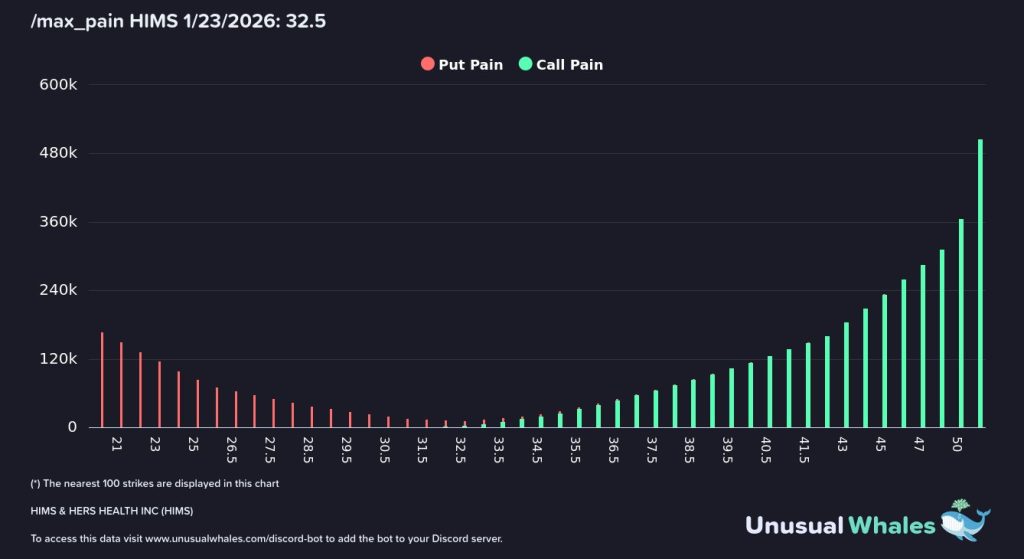

HIMS Stock Options Show 500K Call Build Through $50 Ahead of Jan 23 Expiry

Options traders are aggressively positioning in Hims & Hers Health as the January 23 expiration approaches. With the stock trading near $31, the options market is centered around a $32.50 max pain level—an area that could act as a short-term inflection point. Current positioning suggests rising expectations for volatility rather than a clearly defined directional move.

Key Options Market Signals

Max Pain Level and Price Positioning

HIMS is trading just below the $32.50 max pain level, the strike where combined losses for option holders are theoretically maximized. When price hovers near this level into expiration, even modest moves can trigger significant dealer hedging activity, amplifying volatility.

Downside Protection and Put Exposure

Put positioning steadily tapers from the low $20s through the low $30s. The heaviest put concentration sits in the low $20 range, indicating that much of the activity represents downside insurance rather than outright bearish speculation.

This structure suggests limited conviction that HIMS will experience a sharp downside move before expiration, even if near-term price swings increase.

Call Buildup From $36 to $50

Call activity remains relatively muted below $36 but increases dramatically above that level. Open interest rises from roughly 100,000 contracts to nearly 500,000 contracts across strikes extending through $50.

As noted in the analysis, calls “absolutely explode from around $36 through $50,” reflecting aggressive bullish positioning. This type of call wall creates asymmetric upside risk, particularly if price momentum begins to build.

Why This Matters for HIMS Stock

The heavy call concentration above current prices introduces the potential for a gamma-driven move. If HIMS starts to climb, market makers who sold these calls may be forced to hedge by buying shares, creating a feedback loop that accelerates upside momentum.

At the same time, the sheer size of call positioning at higher strikes increases the likelihood of profit-taking if price advances rapidly into the $40s, potentially capping gains after an initial surge.

Outlook Ahead of the January 23 Expiration

The current options landscape points to elevated volatility rather than a guaranteed bullish or bearish outcome. Downside pressure appears limited due to light put exposure, while upside sensitivity is concentrated above the $32.50 threshold.

A decisive break above $32.50 could trigger dealer hedging flows that push HIMS toward higher strikes. Failure to reclaim that level may result in consolidation or mild downside drift into expiration.