GOOGL Stock News: Google Cloud Rule-of-40 Score Reaches 78

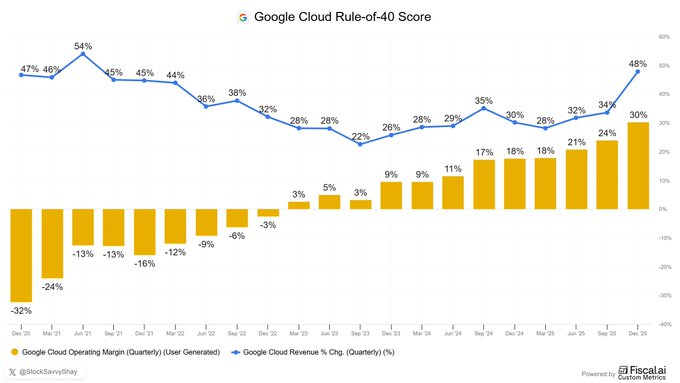

Shares of Alphabet Inc. (GOOGL) are drawing attention after its Google Cloud division posted a Rule-of-40 score of 78. The milestone highlights the company’s ability to balance accelerating revenue growth with improving profitability. As noted by market commentator Shay Boloor, “$GOOGL CLOUD HAS A RULE-OF-40 SCORE OF 78,” underscoring how rare it is to see both metrics expand simultaneously at scale.

The Rule-of-40 metric, widely used in evaluating cloud companies, combines revenue growth rate and operating margin. A score above 40 is considered strong. A score of 78 signals exceptional performance.

Revenue Growth and Margin Expansion

Google Cloud’s turnaround over the past few years has been significant. In mid-2021, operating margins were deeply negative at minus 32 percent, followed by minus 24 percent in subsequent quarters. However, momentum shifted sharply through 2023, 2024, and into 2025.

Revenue growth reaccelerated above 30 percent and approached 50 percent in the most recent reporting period. At the same time, operating margins moved into the high teens and low 20s. This powerful combination of margin expansion and revenue acceleration is what ultimately drove the Rule-of-40 score to 78.

This improvement reflects broader GOOGL revenue expansion and AI stack control, which highlights how Alphabet has tightened integration across its AI and cloud ecosystem.

Infrastructure and AI Platform Convergence

Google Cloud’s performance is built on years of infrastructure investment. Alphabet developed custom Tensor Processing Units, expanded BigQuery enterprise data services, scaled the Gemini model suite, and strengthened Vertex AI tooling. The company also leveraged its global network backbone to optimize cloud delivery.

These elements are converging into a vertically integrated cloud and AI platform capable of competing directly with leading infrastructure providers. The strategy increasingly mirrors a full-stack model where silicon, software, and services operate as a unified system.

Importantly, Google Cloud quarterly profitability via custom chips: demonstrates how proprietary silicon is translating into tangible cost efficiencies and operating leverage.

Why This Matters

A Rule-of-40 score of 78 signals more than strong earnings. It reflects scalable profitability at high growth rates, which is rare in the cloud sector. Many competitors struggle to maintain expansion while improving margins. Google Cloud is currently delivering both.

This dynamic strengthens Alphabet’s competitive positioning within the AI infrastructure landscape. As enterprise demand for AI solutions continues to rise, companies are increasingly looking for tightly integrated ecosystems that combine compute power, AI models, and data services.

Alphabet’s approach positions Google Cloud as a credible alternative to incumbent AI hardware and cloud leaders. The ripple effects could extend across the broader technology sector and influence capital allocation within the S&P 500.

Outlook for 2026

If current trends persist, Google Cloud may continue expanding its profitability while sustaining elevated growth rates. Key drivers to watch include:

- Adoption of AI-powered enterprise tools

- Expansion of custom silicon deployments

- Continued margin improvement through scale efficiencies

- Broader monetization of Gemini and Vertex AI services

Maintaining a high Rule-of-40 score will depend on Alphabet’s ability to preserve both operating leverage and top-line momentum.

My Take

Google Cloud’s 78 Rule-of-40 score is more than a headline metric. It suggests that Alphabet’s long-term AI infrastructure investments are beginning to compound into measurable competitive advantage. While peers often face tradeoffs between growth and profitability, GOOGL is currently delivering both at scale.

Source: Twitter Post by Shay Boloor