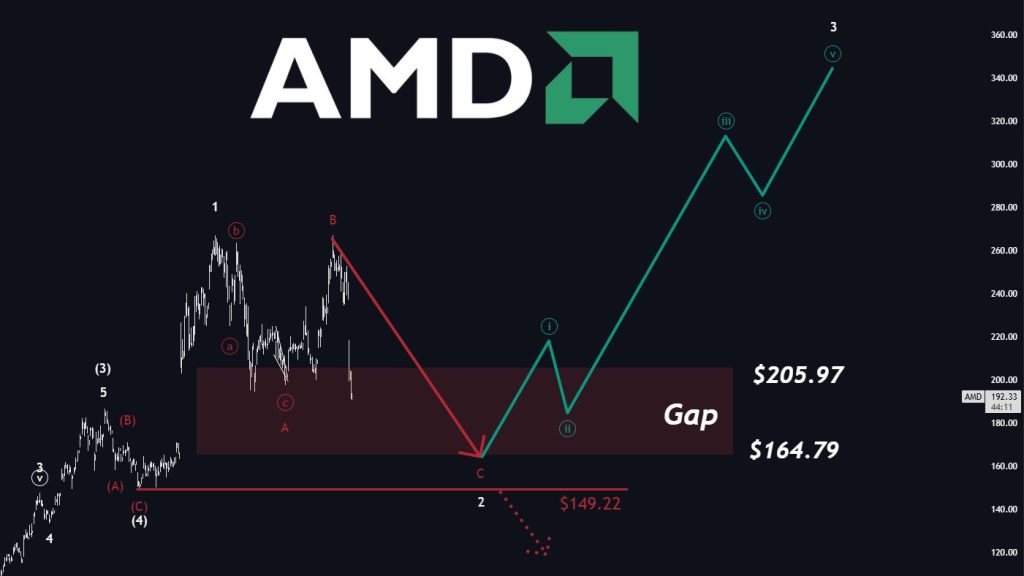

AMD Eyes $164 Gap Fill as Support Faces Test

AMD is approaching a critical technical zone following sustained selling pressure. Current price action suggests the stock may continue lower into a large unfilled gap spanning roughly from $205.97 down to $164.79. This area is emerging as a key checkpoint in the broader corrective structure rather than a brief pullback.

Key Technical Levels in Focus

Gap Zone Between $205 and $164

The most prominent technical feature on the chart is a wide gap located between $205.97 and $164.79. Based on the current structure, AMD appears poised to enter this zone as part of its ongoing correction. Gap fills of this magnitude often act as intermediate magnets for price, especially following strong directional moves.

Market participants are watching closely to see whether this gap attracts buying interest or merely serves as a pause before further downside.

Support Breakdown and Downside Risk

Just below AMD’s current trading level sits a key support line that has so far contained selling pressure. If this support fails, downside risk could increase materially. In that scenario, the decline would not likely stop at the gap zone, with deeper support near the $117 level coming into view.

Such a move would represent a continuation of the broader corrective trend rather than a short-term fluctuation, reinforcing the importance of the gap region as an intermediate target rather than a final floor.

Why This Matters

AMD is entering a technically decisive phase. The way price reacts inside the $164–$205 gap will shape near-term sentiment and positioning. A stabilization within the gap could signal the start of a basing process, while continued weakness would suggest that sellers remain firmly in control.

This setup also influences trader behavior. Rather than attempting to time an exact bottom, many participants are likely to build positions gradually across the gap zone, treating it as an accumulation range rather than a single entry point.

Outlook and Market Implications

As AMD moves deeper into the projected range, its price behavior will determine whether the decline stabilizes after filling the gap or extends toward much lower levels. The $164 area, in particular, stands out as a level where buyers must respond decisively to prevent further technical damage.

Analyst Perspective

From a technical standpoint, AMD’s approach toward the $164–$205 gap appears increasingly likely given the current setup. The critical question is whether meaningful demand emerges inside that zone or whether downside momentum carries the stock toward the $117 region. Price action around $164 is expected to be the defining signal for the next phase of the move.

Source: The Analyst