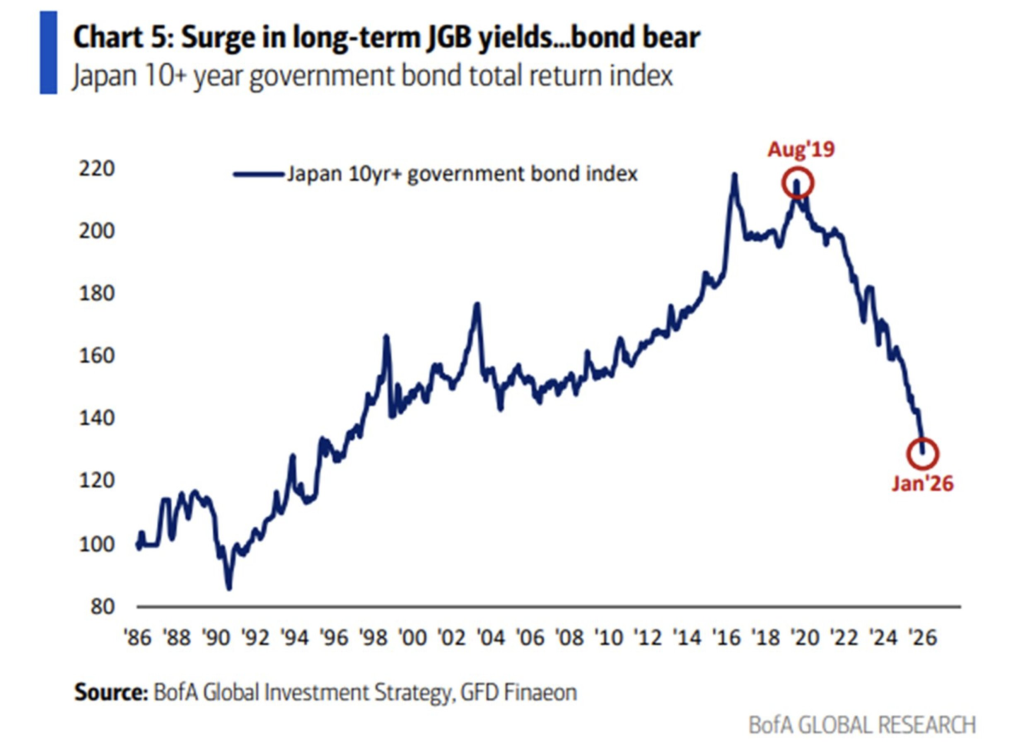

Japan’s 10-Year+ Government Bonds Have Fallen 40% Since 2019 Peak

Japan’s long-term government bonds have suffered one of the sharpest downturns in modern financial history. Total returns on Japanese government bonds (JGBs) with maturities of 10 years and longer have fallen by roughly 40% from their 2019 peak, according to data from Bank of America Global Investment Strategy and GFD Finaeon.

The decline has effectively erased nearly two decades of cumulative gains, marking a dramatic reversal for an asset class long viewed as a pillar of financial stability.

Long-dated JGB prices reverse decades of gains

Japan’s 10-year-plus government bond total return index climbed steadily from the late 1990s through the 2000s and 2010s, supported by falling yields and aggressive monetary easing. That multi-decade bond bull market began to unwind after August 2019, when prices entered a sustained decline.

By early 2026, the index had fallen back to levels last seen in the mid-1990s, effectively wiping out almost a generation of long-term bond performance.

Rising yields drive prolonged losses

The primary driver behind the downturn has been a rise in long-term Japanese government bond yields. Because long-duration bonds are highly sensitive to interest rate changes, even relatively modest yield increases can translate into significant price declines.

As yields continued to climb, losses compounded, delivering sustained pressure on investors and institutions with exposure to long-dated JGBs.

Why It Matters

- challenges the assumption that sovereign bonds are inherently low-risk assets

- exposes banks, insurers, and pension funds to significant mark-to-market losses

- highlights duration risk during periods of shifting monetary policy

For financial institutions holding long-dated Japanese government bonds, the sell-off has resulted in tangible balance-sheet stress, tighter capital conditions, and increased systemic risk.

Broader Implications for “Safe-Haven” Assets

What makes the downturn particularly notable is its impact on long-standing beliefs about government bonds as reliable safe havens. When sovereign debt from a major economy like Japan experiences deep and prolonged drawdowns, traditional risk models are forced into question.

The scale of the decline demonstrates how changes in interest rate regimes can overturn decades of perceived bond stability and capital preservation.

Outlook

The collapse in Japan’s long-term bond market underscores that government bonds are not inherently risk-free, especially after prolonged periods of ultra-low interest rates. As central banks adjust policy and yields rise, duration risk has emerged as a key vulnerability even in conservative portfolios.

Going forward, investors may need to reassess the role of long-dated bonds as defensive assets in environments where monetary conditions are tightening.