Global 10% Tariff Could Push US Customs Revenue to $300–400 Billion Annually

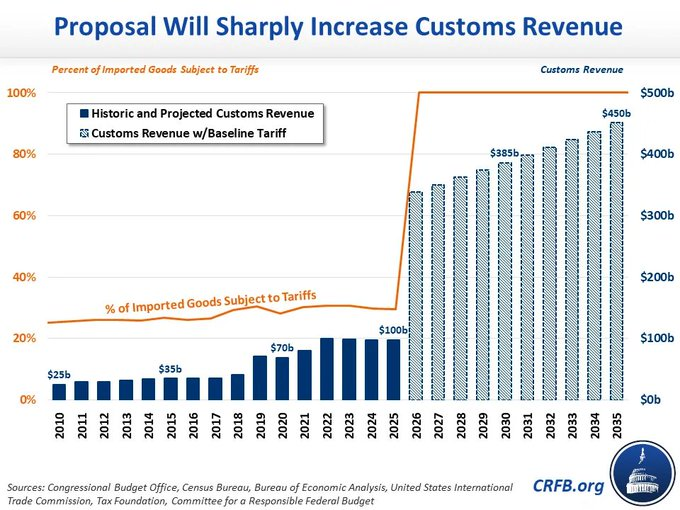

Discussion around US trade policy is intensifying as analysts evaluate the potential impact of implementing a uniform global 10% tariff under Section 122 authority. Estimates suggest that such a measure could lift annual customs revenue to between $300 billion and $400 billion.

For comparison, projected customs revenue for 2025 stands near $200 billion, while in 2024 it totaled just $77 billion. The scale of the proposed increase would represent a structural shift in how tariff policy contributes to federal revenue.

Key Revenue Projections

Historical Customs Revenue Trends

Over the past decade, US tariff collections have risen significantly. Around 2010, annual customs revenue stood near $25 billion. By the early 2020s, that figure had climbed to approximately $100 billion before approaching the $200 billion range in current projections.

A proposed Section 122 framework would dramatically expand the scope of tariff coverage. Currently, roughly 25 to 30 percent of imported goods are subject to tariffs. Under a universal 10 percent tariff, that share could approach nearly 100 percent of imports.

Such a shift would fundamentally alter revenue dynamics. By the mid-2030s, projections suggest customs collections could approach half a trillion dollars annually under sustained policy implementation.

Structural Policy Shift Under Section 122

Unlike targeted tariff measures aimed at specific industries or countries, a uniform global tariff would represent a broad-based policy tool. This would move the US from selective duties toward a near-universal import tax framework.

The proposal does not necessarily imply abandoning existing trade agreements, many of which have supported global trade and economic expansion. However, it does highlight how rapidly trade policy direction can shift depending on political leadership.

Recent developments illustrate this volatility. For example:

• Trump announces 10–25 tariffs on European nations

• Record US tariff revenue collections jump

These examples demonstrate that tariff revenue is already playing a larger role in federal finances than in previous years.

Why This Matters

A global 10 percent tariff would have far-reaching economic implications.

On one side, a substantial increase in customs revenue could strengthen the federal government’s fiscal position and reduce reliance on other revenue sources. On the other side, universal import duties would likely reshape global supply chains, alter pricing structures, and affect corporate margins across industries.

Capital markets would also need to reassess risk models, particularly in sectors heavily dependent on global trade. Cost pass-through to consumers, shifts in sourcing strategies, and changes in competitive dynamics could all emerge as secondary effects.

For macroeconomic analysts and equity investors, understanding how tariff expansion interacts with inflation, growth, and trade balances will be essential.

Outlook

If implemented, a global 10 percent tariff under Section 122 would represent one of the most significant changes to US trade policy in decades. Revenue could rise from approximately $200 billion today to potentially $400 billion annually.

However, the fiscal benefit must be weighed against broader economic adjustments, including potential increases in consumer prices and shifts in business competitiveness.

As the policy debate continues, tariff expansion remains a central topic in discussions about trade strategy, federal revenue, and long-term economic positioning.

Source: Twitter Post by Daniel Lacalle