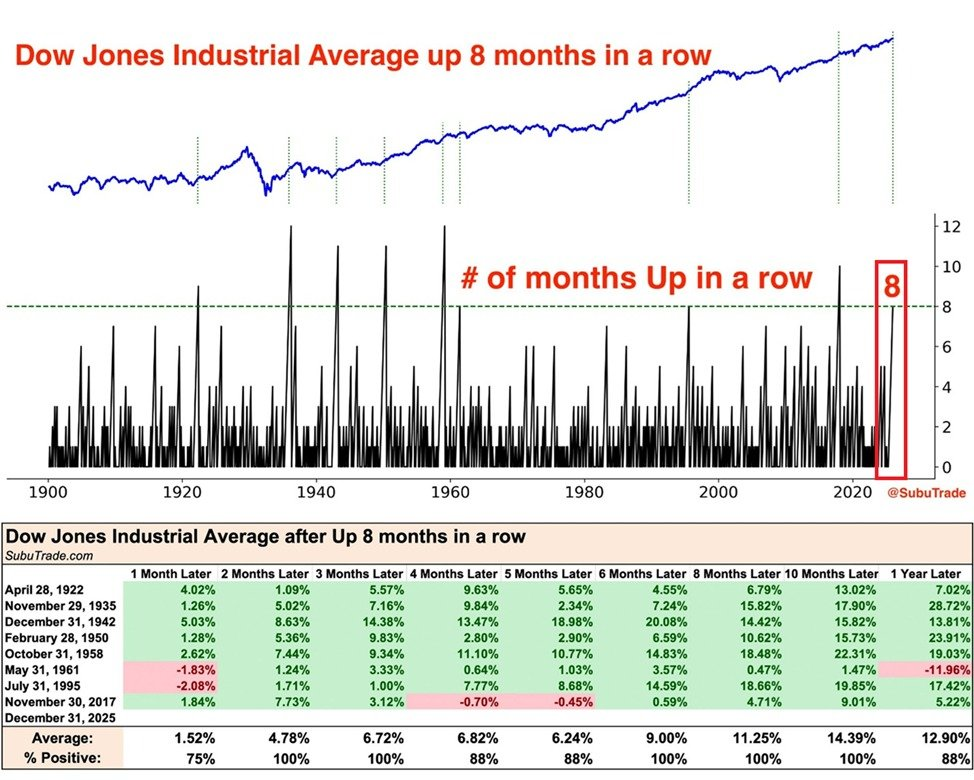

Dow Jones Records Eight Consecutive Monthly Gains, Longest Streak Since 2019

The Dow Jones Industrial Average closed its eighth consecutive month of gains, marking the longest uninterrupted winning streak for the index since 2019. The move places the current rally among the most persistent advances in modern market history and underscores ongoing strength in U.S. equities.

Key Market Data:

1. Dow Jones Industrial Average

Eight consecutive monthly gains represent a rare historical event. Since the 1950s, the Dow has achieved a comparable streak only eight times, making the current run the second-longest on record.

Historical outcomes following similar streaks show a clear pattern:

- The Dow advanced one month later in 6 of 8 cases

- Returns were positive in all cases over the next two and three months

- Average gains measured:

- ~1.5% after one month

- More than 6% after four months

- Over 12% on average after 12 months

These figures suggest that extended momentum phases have historically led to further upside rather than immediate reversals.

2. Broader U.S. Equity Market

The S&P 500 recently concluded its own seven-month winning streak, also the longest since 2019, before posting a modest decline last month. Despite the pause, historical data remains supportive:

- Following similar streaks, the S&P 500 finished higher one month later in 7 of the last 9 occurrences

The alignment of multi-month gains across major indices highlights broad participation in the current market trend.

Why This Matters

Sustained multi-month advances typically reflect:

- Continued institutional capital inflows

- Confidence in corporate earnings growth

- Resilient investor sentiment despite macroeconomic uncertainty

When both the Dow Jones and S&P 500 exhibit prolonged winning streaks, it often signals that underlying market momentum remains intact, even as short-term pullbacks occur.

As noted by market observers, eight consecutive months of gains represent an uncommon level of consistency in today’s market environment.

Market Outlook

Historical precedent suggests that momentum following extended winning streaks often continues into subsequent months. While elevated valuations and macro risks warrant caution, data favors a constructive medium-term outlook.

Key factors to monitor going forward include:

- Earnings sustainability

- Interest rate expectations

- Signs of momentum fatigue or volume divergence

Source: The Kobeissi Letter