U.S. GDP Growth Slows to 2.2% in 2025, Weakest Expansion in Four Years

U.S. economic growth softened in 2025 as real GDP expanded by 2.2% compared with the previous year, according to official data. This represents a slowdown from 2.8% growth in 2024 and marks the weakest annual expansion since the early post pandemic recovery period.

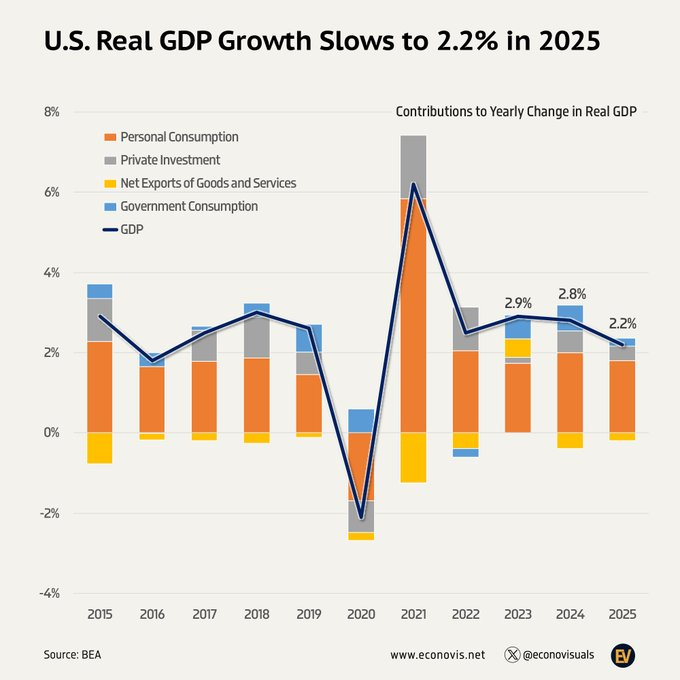

Data highlighted by Econovisuals shows that overall economic momentum eased compared with the prior two years. The chart titled “U.S. Real GDP Growth Slows to 2.2% in 2025” illustrates how contributions from personal consumption, private investment, net exports, and government consumption combined to produce a more moderate expansion.

Consumer Spending and Business Investment

Despite the slowdown, domestic demand remained resilient. Growth in 2025 was primarily supported by consumer spending and private investment.

Healthcare services contributed approximately 0.51 percentage points to overall GDP growth. Investment in information processing equipment added around 0.37 percentage points. When combined with software investment, these technology and service oriented sectors accounted for more than half of total GDP expansion during the year.

Analysts noted that the core momentum came from domestic consumption and private investment, while net exports and government consumption provided only modest support.

Broader Economic Context

The longer term trajectory of U.S. output shows a clear pattern. After the sharp contraction in 2020 during the pandemic and the strong rebound in 2021, growth gradually normalized. GDP expanded by 2.9% in 2023 and 2.8% in 2024 before slowing further to 2.2% in 2025.

Recent quarterly data had already pointed toward cooling momentum. Coverage such as US GDP slowing late in 2024 underscored how output decelerated toward the end of last year even as inflation metrics remained firm.

At the same time, structural growth themes continued to play a role. Analysis on AI spending’s contribution to GDP growth shows that artificial intelligence related investment powered a significant portion of economic expansion earlier in 2025.

Why This Matters

The moderation to 2.2% signals a shift toward a more balanced and sustainable pace of expansion. Slower growth has implications for:

- Corporate earnings expectations

- Consumer demand trends

- Federal Reserve policy considerations

- Equity market performance, including benchmarks such as the S&P 500

While growth remains positive, the deceleration may influence both short term investor sentiment and longer term views on economic resilience.

Outlook for 2026

If current trends persist, the U.S. economy may continue expanding at a moderate pace rather than returning to the stronger post pandemic growth rates. Key variables to watch include:

- The trajectory of consumer spending

- Continued strength in healthcare and technology investment

- Business capital expenditure trends

- Monetary policy adjustments

The composition of growth will likely matter more than the headline figure. Technology and service sectors appear positioned to remain central pillars of expansion.

My Take

The 2.2% growth figure tells the story of an economy settling into a more sustainable, but less dynamic rhythm. The composition is particularly notable. Healthcare and technology related investment are carrying much of the weight while other sectors cool.

This does not resemble a dangerous downturn. Instead, it appears to reflect a natural normalization phase following the powerful post pandemic rebound years.

Source: Twitter Post by Econovis