Analyst Warns of Potential 2026 Market Shock as U.S.-China Energy Tensions Intensify

A market analyst is warning that escalating U.S.-China energy tensions could become a major source of global market stress in 2026. The assessment focuses on recent developments surrounding Venezuelan oil, arguing that shifts in control and access to strategic energy resources may have far-reaching consequences for financial markets.

According to the analysis, disruptions tied to geopolitical competition could extend beyond oil, influencing equities, foreign exchange markets, and digital assets such as Bitcoin.

Key Developments Behind the Warning

Venezuela’s Strategic Role in Global Energy

Venezuela holds more than 300 billion barrels of proven crude reserves, the largest in the world. China currently purchases an estimated 80–85% of Venezuela’s crude exports, often at discounted prices that play a key role in Beijing’s long-term energy security strategy.

The analyst argues that increasing U.S. influence over Venezuelan energy assets could reduce China’s access to this supply. Such a shift would come at a critical time, as China continues to prioritize stable and affordable crude imports amid global supply risks.

These developments are viewed as part of a broader pattern of U.S. pressure on China’s energy supply chains, following earlier actions affecting Iranian oil exports.

Expanding Resource Competition

Beyond oil, the analyst points to China’s decision to introduce restrictions on silver exports starting January 2026. This move is interpreted as a signal that competition between major powers is expanding into a resource-for-resource dynamic, where strategic commodities are increasingly used as leverage in geopolitical negotiations.

Together, oil and metal supply pressures suggest a widening front in global resource competition.

Why Markets Are Paying Attention

The analyst warns that disruptions to China’s Venezuelan crude supply could trigger multi-asset market reactions, including:

- Higher oil prices and renewed inflation concerns

- Weakness in emerging market equities, potentially spilling into developed markets

- Short-term strength in the U.S. dollar as a safe-haven currency

- Increased pressure on emerging market currencies

This pattern closely resembles volatility episodes seen in early 2025, when energy supply risks contributed to sharp swings across global markets.

Disruptions to China’s Venezuelan crude supply chain could have wider market effects across multiple asset classes, from traditional equities to digital assets like Bitcoin.

Implications for Bitcoin and Crypto Markets

In the near term, the analyst expects liquidity tightening to weigh on Bitcoin and other crypto assets as investors reduce exposure to risk. However, if geopolitical uncertainty persists and currency volatility increases, Bitcoin could eventually regain appeal as a macro hedge against systemic risk.

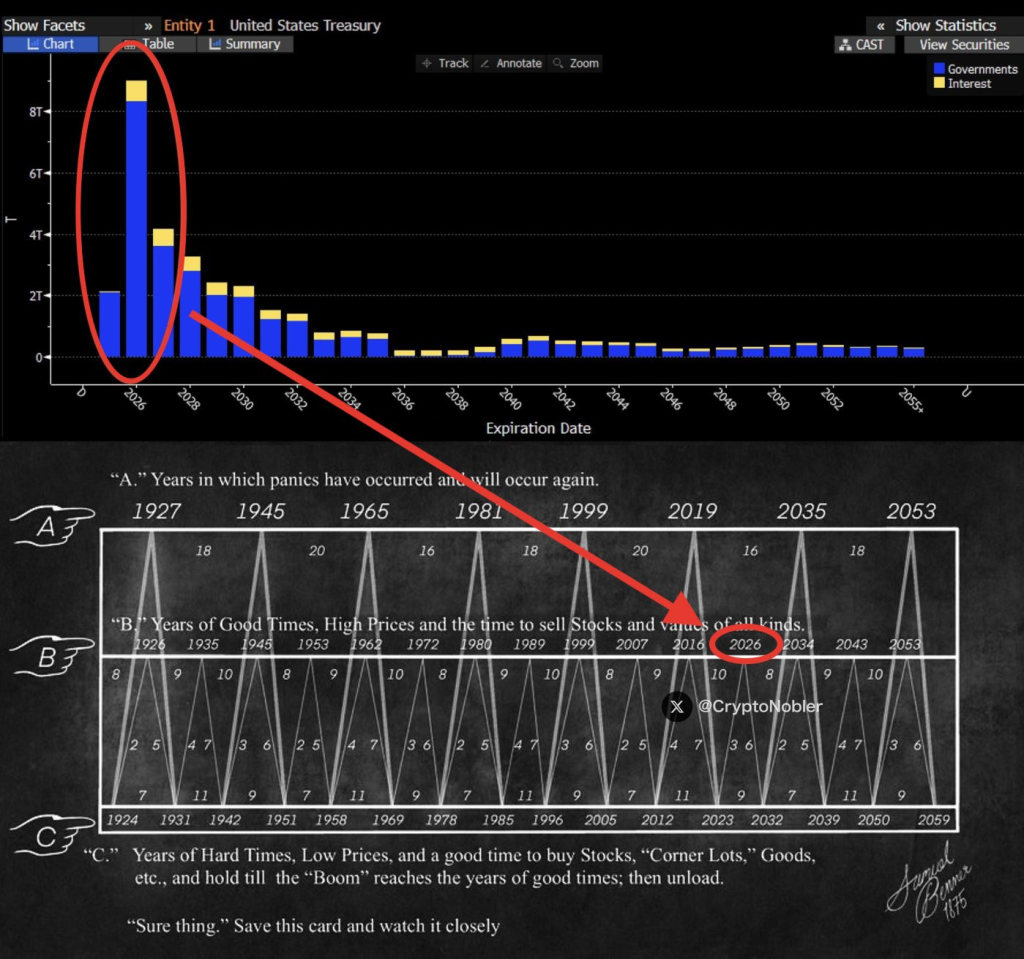

Outlook for 2026

Looking ahead, the analyst outlines a scenario in which geopolitical competition, commodity security, and financial markets become increasingly intertwined. Energy disruptions could act as a catalyst for broader risk-off sentiment, while prolonged uncertainty

Although the scenario remains speculative, the analysis highlights how developmen

Analyst Commentary

Energy security and great-power rivalry rarely remain confined to a single sector. If China’s access to discounted crude tightens while it simultaneously restricts exports of strategic metals such as silver, markets could face a period of tit-. Historic

Source: 0xNobl