USD/JPY & TOPIX: Positive Correlation Returns After 20+ Years in February 2026

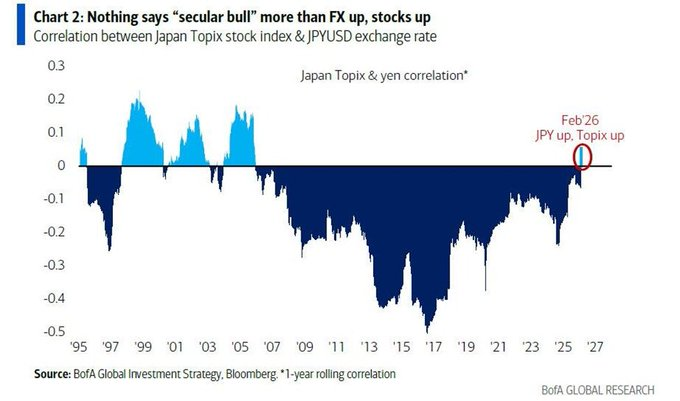

Japan’s financial markets are exhibiting a rare structural shift. In February 2026, the 1-year rolling correlation between USD/JPY and the TOPIX index moved above zero for the first time since 2005, signaling that the Japanese yen and domestic equities are now rising in tandem.

According to market data highlighted by The Kobeissi Letter, this marks a decisive break from a two-decade inverse relationship in which a stronger yen typically pressured stocks, while currency weakness supported exporters and lifted equity performance.

For most of the past 20 years, Japan’s currency and stock market moved in opposite directions. That long-standing dynamic has now reversed — potentially signaling a broader macro transition rather than a temporary anomaly.

Key Market Data Behind the Shift

Correlation Turns Positive

The 1-year rolling correlation between TOPIX and JPYUSD crossed into positive territory in February 2026, marking the first such occurrence since 2005.

The 1-year rolling correlation between Japan TOPIX and JPYUSD exchange rate moved above zero in February 2026, a level last seen in 2005.

This statistical shift suggests currency and equity markets are no longer offsetting each other but instead moving in sync — an uncommon alignment in Japan’s modern market history.

Performance Over the Past Year

The magnitude of the move reinforces the structural nature of the shift:

- The Japanese yen has appreciated roughly 1% against the U.S. dollar.

- The TOPIX index has surged approximately 38% over the same period.

The simultaneous rise in both assets indicates more than a conventional equity rally. It reflects synchronized capital flows and a potential reassessment of Japan’s macroeconomic outlook.

Why This Positive Correlation Matters

Historically, periods in which both a nation’s currency and equities rise together have often coincided with early-cycle bull markets driven by structural capital inflows and improving domestic fundamentals.

The current alignment challenges the traditional risk-on/risk-off framework long associated with Japan, where exporters benefited from yen weakness and equity gains were currency-driven.

Additional cross-asset developments reinforce the broader macro transition:

Japan’s bond market has undergone significant repricing. As previously covered in Japan’s 10 Year Government Bonds, long-dated government bonds have fallen nearly 40% since their 2019 peak, reflecting major changes in yield dynamics and monetary expectations.

Meanwhile, global FX stability provides context. In FX EUR/USD support levels, the pair has held firm near the 1.1610 level at the 61.8% Fibonacci retracement, signaling broader currency market stabilization.

Taken together, these developments suggest Japan’s equity strength is unfolding within a wider macroeconomic realignment rather than in isolation.

Broader Implications for Global Macro

A rising yen alongside rising equities signals that investor behavior may be shifting relative to prior cycles. Instead of stocks benefiting from currency weakness, markets appear to be pricing in structural strength, capital inflows, and potentially improving domestic fundamentals.

If sustained, this shift could:

- Alter how global investors interpret Japanese macro signals

- Reshape cross-asset positioning strategies across Asia

- Influence regional capital allocation decisions

Breaking from a 20-year inverse pattern may indicate the emergence of a new market regime.

Outlook

If the positive USD/JPY–TOPIX correlation persists, it could confirm a deeper structural transformation within Japan’s financial markets. Investors will closely monitor whether the alignment continues across multiple quarters or proves cyclical.

A sustained period of currency appreciation alongside equity gains would challenge long-held assumptions and potentially mark the early stages of a new bullish phase for Japanese assets.

Source: Twitter post by The Kobeissi Letter