XRP Reclaims $2.40 as Traders Return

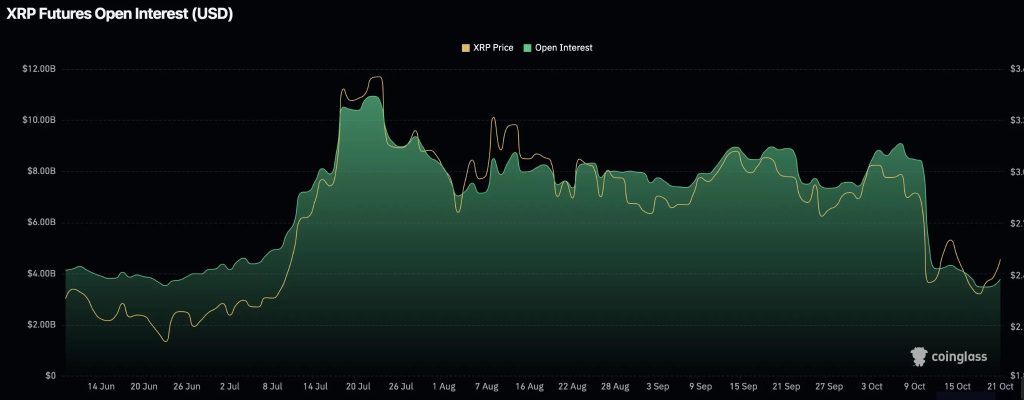

After weeks of sideways trading, XRP is showing signs of life. The token has reclaimed the $2.40 level while futures open interest is rising steadily—a combination that typically indicates fresh bullish positions rather than just short covering. Data from Coinglass confirms that traders are rebuilding exposure, suggesting quiet confidence is returning to the market.

Market Activity

Thus, the data supports Tom Tucker statement: momentum, in this context, equals strength. XRP’s futures open interest has bounced back toward the $6–7 billion range after dropping sharply in early October. At the same time, price has stabilized around $2.40, a historically significant support zone. This alignment between rising open interest and stable pricing usually points to accumulation—traders entering positions ahead of a potential breakout. The $2.40 level previously acted as resistance, so holding it as support now suggests underlying strength. If momentum continues, the next targets are $2.80 and $3.00.

The pattern differs sharply from September and early October, when both price and open interest fell together—classic signs of liquidation and waning interest. Now, the trend has reversed. Open interest is climbing while price holds steady, often a precursor to increased volatility in the direction of the trend.

Broader Context

Several factors support XRP’s recent recovery. Bitcoin’s stability above $70,000 has historically triggered capital rotation into major altcoins. The resolution of regulatory uncertainty from the SEC-Ripple case has also made institutional traders more comfortable re-entering. Rising open interest, especially with positive funding rates, often precedes volatility expansions that favor the prevailing direction.

Pingback: XRP Major Breakout: Analyst Predicts $4-5 Target - Finly.News