XRP Holders Trigger Major Sell-Off

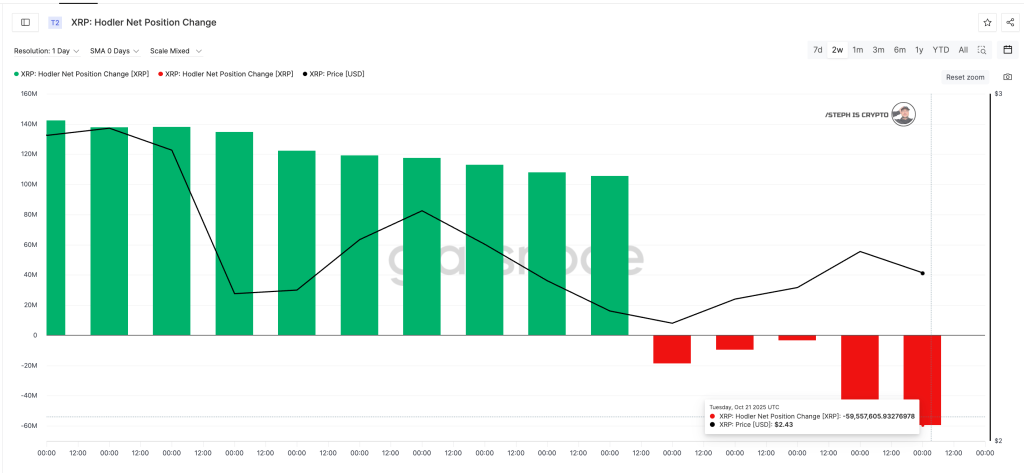

- According to STEPH IS CRYPTO, long-term XRP holders have ramped up their selling. On-chain data shows net position change dropped from –18.5M XRP to –59.5M XRP in just four days — a massive 220% increase in outflows.

- After nearly two weeks of steady buying (green bars), holders suddenly switched to heavy selling (red bars). Meanwhile, XRP’s price held around $2.43, suggesting investors started taking profits near recent highs instead of continuing to accumulate.

- This pattern shows long-term holders are locking in gains, likely expecting some volatility after XRP’s strong rally. These quick distribution phases often come before short-term price drops, especially after extended buying periods.

- Analysts note this doesn’t mean a bearish outlook overall — it’s more of a rotation phase where profits get moved into other assets or stablecoins.

- The spike in outflows matches typical post-rally behavior, where whales and early investors cash out. The fact that prices stayed stable while this happened confirms the selling came from long-term positions, not panic.