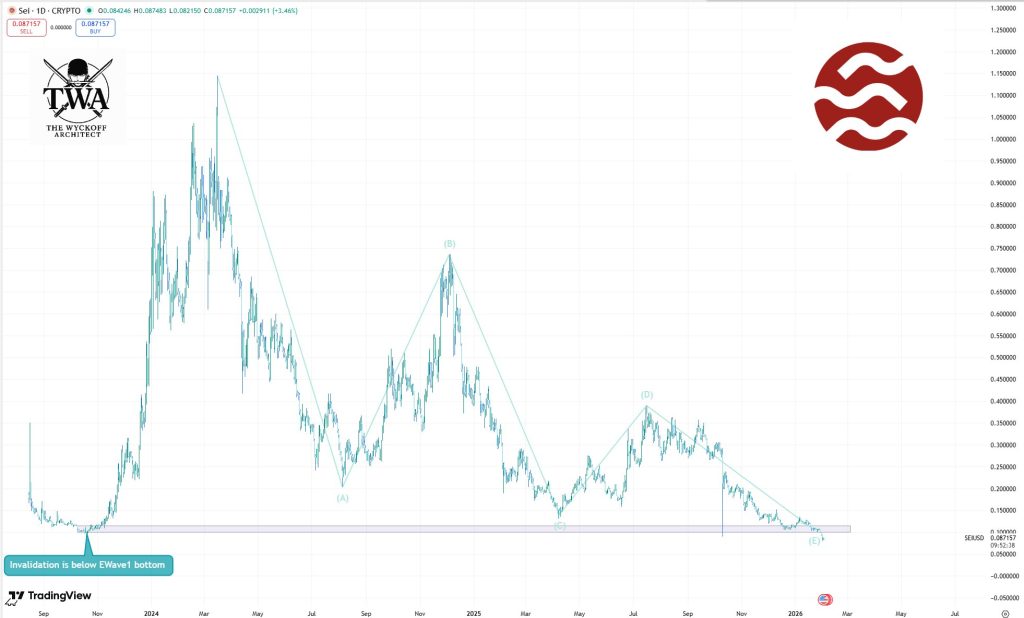

SEI Breaks Below $0.10, Invalidating Elliott Wave Structure

SEI has reached a critical technical turning point after falling below the $0.10 support level. The move invalidated the Elliott Wave structure that many traders were relying on to map the asset’s long-term trend. According to technical analysts, this breakdown removes a key framework for price expectations and leaves SEI without a clearly defined directional bias.

Key Technical Developments

Elliott Wave Invalidation

The decisive breakdown occurred when SEI dropped below the Wave 1 low, a level that must remain intact under Elliott Wave rules for the structure to stay valid. Once price moved beneath that threshold, the entire wave count was rendered unusable.

As noted by technical analyst The Wyckoff Architect, the invalidation aligns with current price action in the $0.08–$0.09 range, confirming that the prior long-term setup can no longer be applied.

Failed Wave 2 Expectations

Earlier in the cycle, when SEI was trading near $0.35, market participants largely expected a corrective move toward the $0.10 area to complete a textbook Wave 2 pullback. The critical condition for that scenario was that price needed to hold above the Wave 1 starting point.

Instead, SEI continued lower and decisively broke beneath that level, officially invalidating the entire Elliott Wave count and eliminating the anticipated recovery structure.

Broader Downtrend Context

The chart shows a prolonged downtrend extending into early 2026, with price steadily grinding lower before breaking former support. Once the Wave 1 bottom failed, the technical structure collapsed, leaving SEI trading in a zone with no established support framework.

Current price action around $0.08–$0.09 reflects this loss of structure and highlights the absence of clear reference levels for buyers or sellers.

Why This Matters

The Elliott Wave framework served as the primary technical roadmap for many SEI traders. When a widely followed structure fails, markets often enter a phase of uncertainty as participants reassess positioning and expectations.

Without a valid pattern in place, SEI becomes more vulnerable to:

- Increased volatility

- Further downside pressure

- Sharp, sentiment-driven price swings

Until a new structure forms, technical confidence remains weak.

Outlook and Risk Considerations

In the near term, SEI remains in technical “no-man’s land.” The lack of a valid Elliott Wave structure means traders have fewer tools to define risk and targets. Further declines are possible until new support levels are established and price action stabilizes.

This breakdown serves as a cautionary signal for traders relying on outdated technical models. Any sustainable recovery will likely require the formation of a new base and a clearly defined trend before confidence can return.

Sources:The Wyckoff Architect