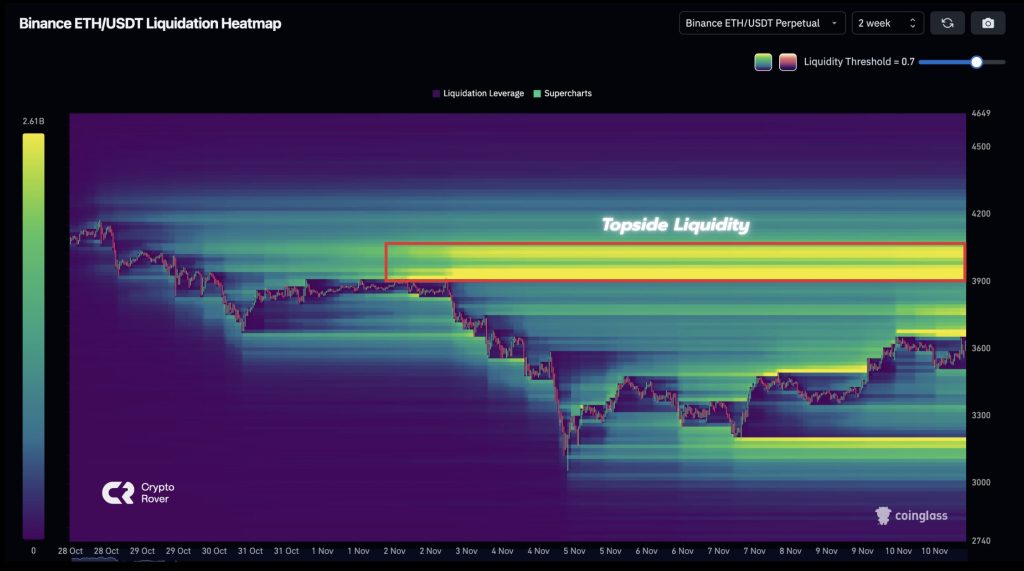

Ethereum Price Setup Near Major Liquidity Cluster

- There’s a massive liquidity cluster sitting right at ETH’s range highs between $3,900 and $4,000. The Binance liquidation heatmap lights up bright yellow and green in this zone—a clear sign that tons of leveraged positions are stacked there. With ETH trading well below these levels right now, the setup is pretty straightforward: if momentum kicks in, the market has every reason to push toward that liquidity and sweep those positions.

- Here’s where it gets interesting. This technical picture is forming just as regulators weigh new tax rules on crypto trading. The proposals target transaction taxes and leverage-based activity specifically. Industry players are sounding the alarm—these changes could put serious pressure on smaller trading firms and liquidity providers, potentially forcing bankruptcies and pushing talent overseas to friendlier regulatory environments. Since leveraged trading is huge in ETH markets, policy shifts like this could crank up volatility right when all this liquidity is clustered together.

- On the fiscal side, policymakers are running the numbers. The concern? Taxing leverage flows might actually shrink budget revenues if trading liquidity dries up. Industry reps are pushing back with an alternative: raise profit taxes instead. Their argument is simple—it protects market liquidity, keeps trading volumes stable, and maintains government revenue without destabilizing derivatives markets.

- These tax proposals are part of a bigger regulatory wave that includes new reporting requirements, capital-gains adjustments, and revised tax thresholds for crypto. Analysts expect these changes could hit employment in the digital-asset sector, reduce income tax contributions if companies downsize, and shift profit-tax revenues depending on how firms adapt.

Source: Crypto Rover