Ethereum Coin Price News: $1,700 Level in Focus

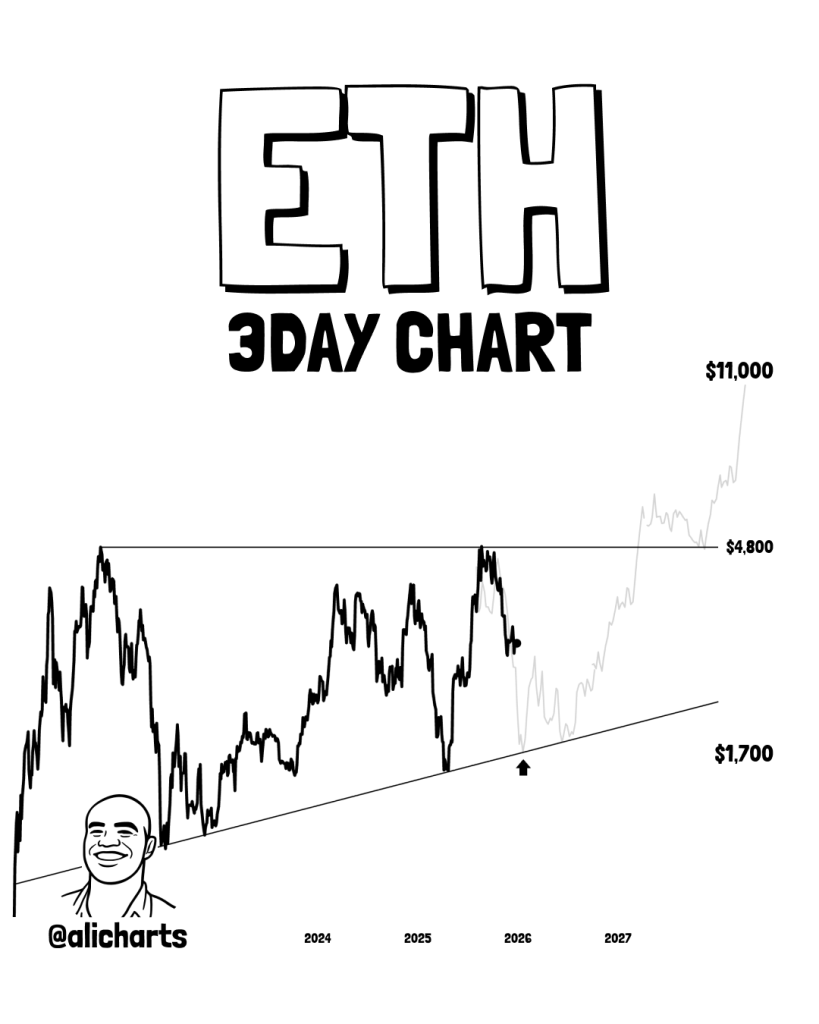

- In a recent statement, Ali Charts highlighted that the $1,700 level “looks like a great spot to buy Ethereum $ETH,” framing this as a proposal grounded in long-range ETH Coin market structure rather than short-term trading noise. The chart shared alongside the comment shows Ethereum’s price history on a three-day timeframe, with a gradually rising trendline extending from prior cycle lows and intersecting near the $1,700 region. This technical “proposal” implies that ETH Coin could find support around that zone, while the clear risk remains that a decisive drop below the trendline would challenge the bullish structure and could pressure long-term holders, potentially leading to prolonged downside pressure or exits at lower valuations.

- Financial impact considerations in the ETH Coin discussion revolve around how a move toward or below $1,700 could affect broader crypto sentiment and capital allocation, with the alternative view being that maintaining that level may restore confidence in the uptrend. The chart also visually references historical resistance near $4,800 and a speculative extension toward approximately $11,000, though these appear as illustrative projections rather than confirmed targets.

The $1,700 level looks like a great spot to buy Ethereum $ETH based on long-range market structure analysis.

- This reinforces that the primary alternative to downside pressure is a potential long-term recovery phase if Ethereum holds structural support. The wider ETH Coin context includes market participation cycles, macro liquidity conditions, and continued crypto adoption, all of which can influence whether such technical levels hold or fail.

- Ultimately, this Ethereum Coin analysis matters because structural levels such as $1,700 can become psychological anchors in crypto markets, shaping momentum, sentiment, and capital flows. Whether ETH Coin stabilizes or weakens around this area may help define the next major price phase, influencing how market participants assess risk, trend strength, and long-term positioning across the broader crypto market.

My Take: The $1,700 zone represents more than just a technical level—it’s a psychological battleground where Ethereum’s long-term trajectory gets tested. If ETH holds above this trendline support, it could reignite confidence among institutional and retail players alike. But a breakdown here might trigger cascading liquidations and force a deeper correction, making this level absolutely critical for anyone watching crypto markets closely right now.

Source: Ali Charts