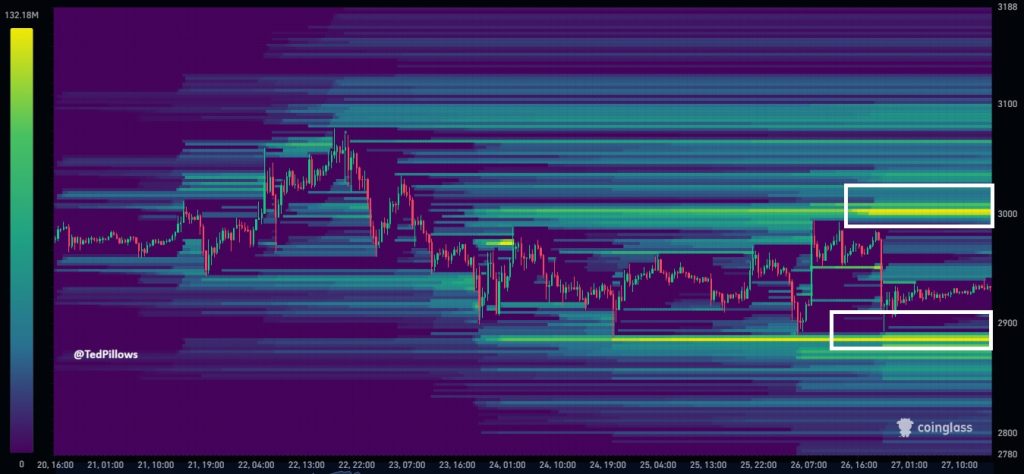

ETH Coin News: Key Liquidity Levels Near $3,000 and $2,900

- Two notable liquidity clusters have formed that could strongly influence short-term ETH price movements, making this an important ETH Coin News update. There are “2 decent liquidity clusters right now,” with short liquidations positioned near the $3,000 level on the upside and long liquidations sitting just below the $2,900 level on the downside. Heatmap data visually confirms these areas, where brighter zones indicate concentrations of ETH orders that may trigger liquidations if price reaches them.

- This setup creates a narrow risk band for ETH, where price movement toward either level could accelerate quickly once liquidation orders are activated. On the upside, a move toward the $3,000 ETH level would force short liquidation orders to unwind, often contributing to sharp upward momentum. On the downside, a move below $2,900 would threaten long ETH positions, potentially producing selling pressure as positions are forcibly closed. Such liquidity clusters often act like magnets in the market, drawing ETH price toward them due to the volume density surrounding these zones.

On the upside, there are short liquidations sitting around the $3,000 level. On the downside, there are long liquidations sitting below the $2,900 level. Which level would Ethereum hit first?

- The broader context shown in the ETH liquidity heatmap reinforces this pattern, with repeated testing of the mid-range zone and visible depth accumulation around both highlighted levels. This suggests that the market is currently in balance while waiting for a volatility trigger. Which level is reached first remains an open question, as momentum, sentiment shifts, or broader crypto-market moves could tip the balance.

- This ETH Coin News development matters because liquidation clusters can accelerate ETH price movement once triggered, shaping short-term trading conditions and contributing to rapid shifts in market sentiment.

My Take: The $3,000-$2,900 range creates a perfect storm scenario where either direction could trigger cascade effects. Smart traders are likely watching both levels closely, ready to react once the market picks its direction. This tight liquidity setup often precedes significant volatility.

Source: Ted