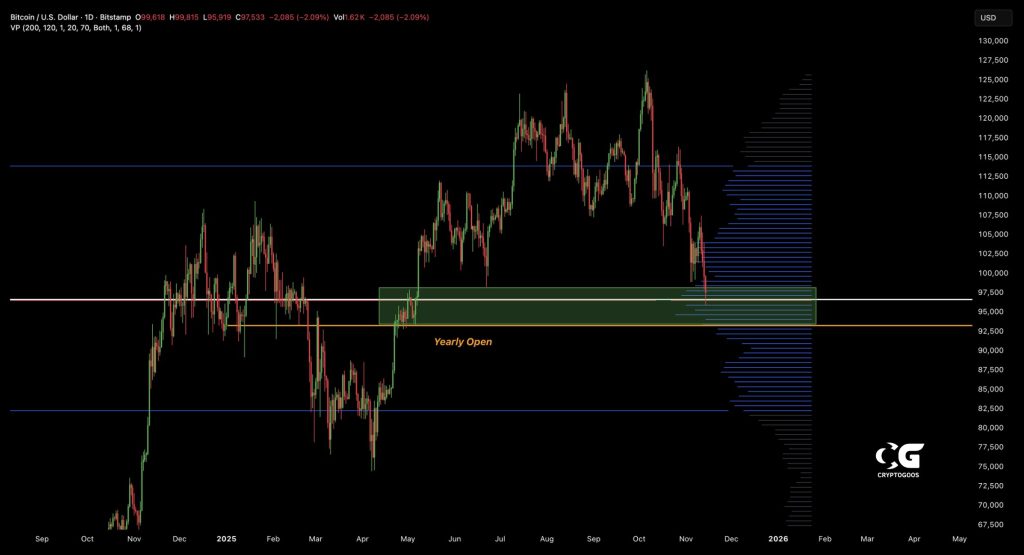

Bitcoin Nears Critical Support Zone

- Bitcoin has reached one of its most significant technical zones of the year. If a bounce is coming, this is where it should happen. Currently trading around $97,500, BTC sits directly on a wide support band reinforced by historical price action and a major Volume Profile shelf. This area also lines up with the Yearly Open near $93,000, creating a concentrated pocket of structural demand.

- This setup reflects how markets respond to critical thresholds. Just as industries face pressure from sudden policy changes—whether through financial strain, bankruptcies, or talent loss—Bitcoin relies on this support cluster to maintain stability. Losing this zone could expose the asset to deeper downside, much like abrupt regulatory shifts can destabilize entire sectors.

- The support zone also acts as a market-protective mechanism. The thick volume accumulation here suggests traders have historically bought heavily in this range and may step in again to defend it, reducing the risk of a sharper decline.

- Bitcoin’s position at this structural floor carries weight for the broader crypto economy—from mining operations and blockchain startups to capital flows and sentiment across digital assets. A breakdown below the Yearly Open could weaken confidence and slow investment, creating ripple effects similar to those seen when fiscal changes reshape industry dynamics.

- The chart shows Bitcoin has reacted to this zone repeatedly throughout the year, with prior reversals originating from the same support cluster. Now that price is back here, traders are watching to see if buyers return to fuel a recovery.

- As Bitcoin tests this critical level, the market has reached a turning point. Holding above $93,000–$97,000 keeps the bullish structure alive. Losing it opens the door to a deeper pullback. For now, all eyes are on this region as the key battleground for Bitcoin’s next move.

Source: CryptoGoos