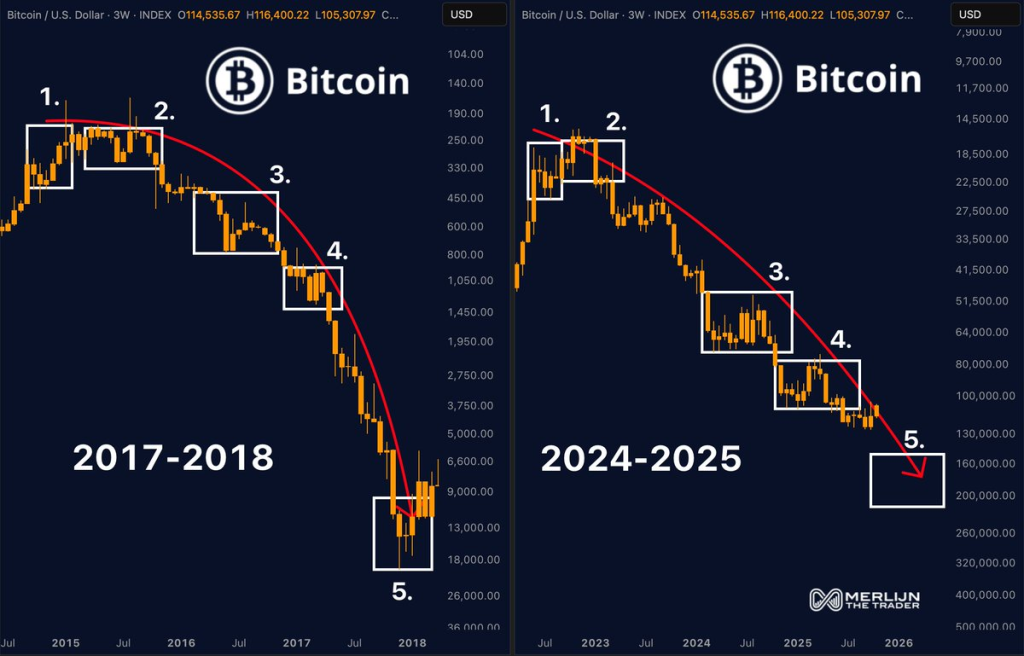

Bitcoin Mirrors 2017 Crash Pattern, Trader Warns

- Trader Merlijn The Trader believes Bitcoin is following the same playbook it used during the 2017–2018 crash. Looking at long-term three-week charts, he’s spotted what he calls striking similarities between then and now—five distinct phases that could mean we’re heading into the final painful leg down before things turn around.

- According to his analysis, Bitcoin has already moved through four major consolidation phases that mirror 2017–2018. We’re now in Phase 5, what he calls the “max pain” moment—when traders typically throw in the towel. But here’s the twist: Merlijn argues this isn’t real capitulation. Instead, it’s a “launchpad in disguise,” where prices hit bottom before bouncing back. The real danger? Selling near the low and missing the recovery.

- Sure, there could still be more downside ahead. But similar patterns in 2019 and 2020 came right before Bitcoin ripped to new highs. If this plays out the same way, those who hold through the pain and buy strategically could do well when sentiment shifts from fear back to greed. That said, macro factors like liquidity, ETF flows, and interest rates could still change how fast or strong the next rally comes.

As Merlijn The Trader puts it: Same five phases. Same blow-off top. Same emotional curve. Phase 5: Prepare for max pain. This isn’t capitulation. It’s the launchpad in disguise. Brace. Survive. Accumulate.

- What looks like collapse now might actually be the start of Bitcoin’s next big accumulation phase. This repeating pattern highlights Bitcoin’s cyclical psychology—euphoria, denial, panic, recovery. For long-term holders, the takeaway is simple: the worst pain often comes right before the best opportunities.