XAG Pulls Back After Bull Trap as Price Tests Key Support Levels

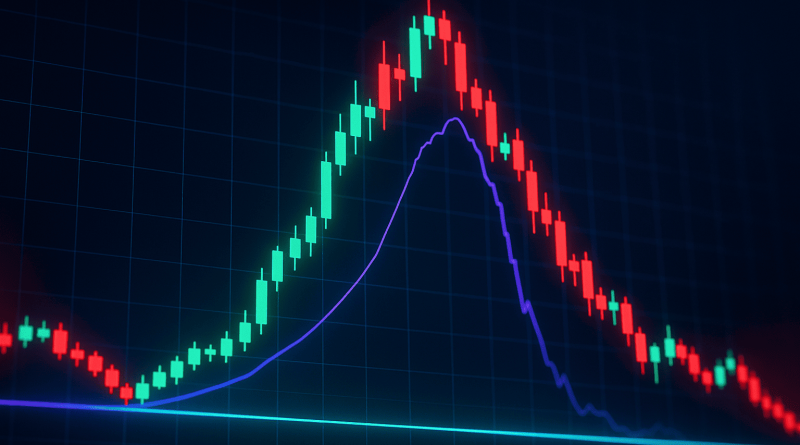

Silver has turned lower after a brief rally earlier in the week failed to hold, resulting in what many now call a bull trap. Wednesday’s gains were quickly erased by the close, signaling lost short-term momentum. XAG is now trading just below $50.00, retreating toward rising trend support that has carried the metal higher since late summer.

Silver pushed toward the $52.00-$53.00 area before sellers stepped in, rejecting the move near descending resistance from recent highs. The sharp reversal marks the bull-trap event, sending Silver back toward the ascending trendline and the upper edge of the Ichimoku cloud. This cloud region has provided support throughout the current trend, and price is testing that zone again as the market assesses the next move.

The 50-day moving average sits around $48.27 and acts as key short-term support. This area may be suitable for limit orders, but strict discipline is needed if the 50-day MA breaks. The convergence of the Ichimoku cloud, rising trendline, and moving average creates an important support cluster. Silver also remains below downward-sloping resistance, indicating lingering pressure despite the broader uptrend.

This pullback matters because Silver recently approached multi-month resistance, and the bull trap highlights persistent uncertainty at elevated levels. How XAG behaves around current support may influence broader precious metals sentiment and shape expectations for volatility or deeper corrections ahead.

source: Stoic Silver Bear