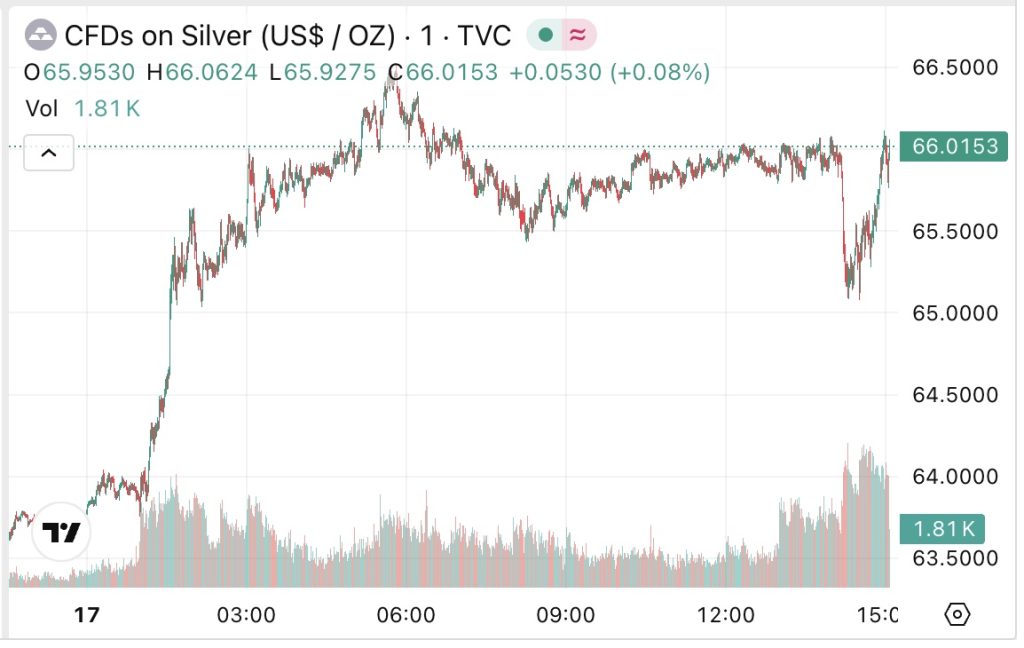

Silver Prices Snap Back to $66 After Minutes-Long Dip

Silver bounced back fast during the latest trading session after dropping briefly, climbing back toward $66 per ounce almost immediately. The really interesting thing here is how quickly these selloffs are ending now. What used to take weeks to recover from now takes just minutes. The intraday chart shows exactly this pattern—a sharp drop followed by an equally sharp climb right back up.

The price slipped into the mid-$65 range for a hot minute before buyers jumped in hard, pushing it back above $66. This all happened within the same session, with trading volume picking up as the recovery gained steam. Looking at how silver’s been moving lately, it’s pretty clear that downside pressure just can’t hold anymore. Every time prices dip below recent levels, buyers show up immediately.

“The silver market’s focus may be shifting as signs of tighter availability become more visible.”

What’s really going on here is that the silver market seems to be responding to supply concerns. While the chart shows price action rather than physical flows, the fact that silver keeps snapping back this fast suggests sellers can’t keep the pressure on. Instead of those long consolidation periods we used to see after selloffs, silver’s been bouncing right back, over and over.

This matters because silver plays a double role—it’s both a monetary metal and an industrial commodity. These faster rebounds are creating more intraday volatility while showing how sensitive the market is to supply stories. As these selloffs keep getting shorter and shorter, price discovery might become more sudden, with short-term swings having a bigger impact on overall market sentiment.

My Take: The compression of silver selloffs from weeks to minutes signals a fundamental shift in market dynamics. This pattern suggests underlying physical tightness that prevents sustained downside moves, potentially setting up for more explosive price action ahead.

Source: Silver Ape King