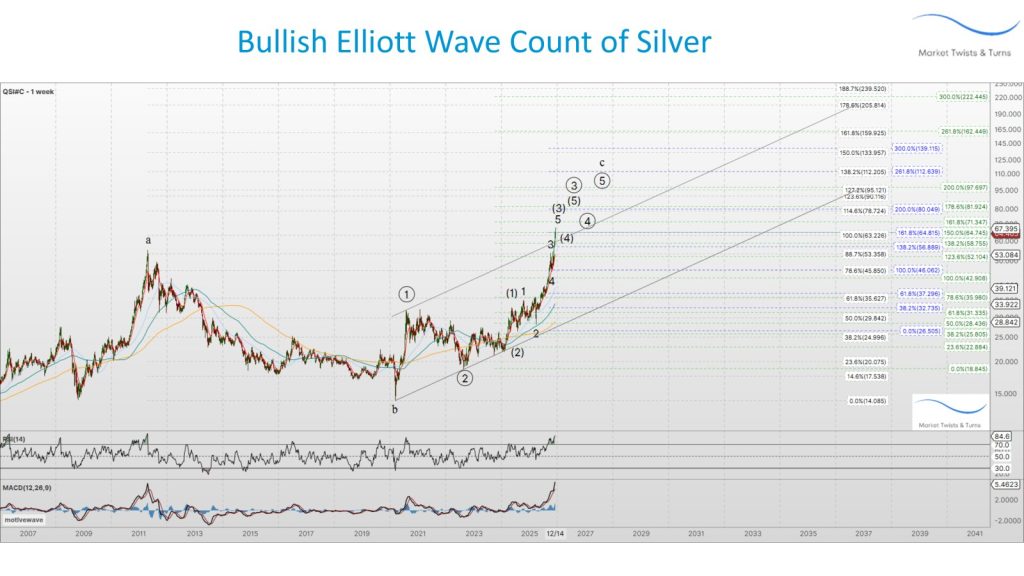

Silver Elliott Wave Analysis Points to $90-100 Target in Primary Wave 3

Silver has been pushing higher with serious momentum lately, and the weekly chart is painting a pretty clear picture of where things might be headed. According to Elliott Wave analysis, we’re likely sitting in Primary Wave 3 right now—the kind of phase where prices tend to move fast and far. The metal broke out from a long consolidation period and hasn’t really looked back since, with pullbacks staying small and controlled.

The wave count shows a clean impulsive structure coming out of that base, and price action has punched through old resistance zones without much hesitation. What’s interesting is how shallow the corrections have been—they’re exactly what you’d expect to see during a healthy uptrend. The momentum indicators back this up too. RSI is holding in elevated territory, and MACD keeps expanding to the upside, both typical signs that the trend still has legs rather than running out of steam.

“Current price action suggests silver may be positioned within Primary Wave 3, a phase typically associated with strong momentum and sustained trend expansion.”

Looking at the Fibonacci projections on the chart, there are some pretty ambitious targets ahead if this wave structure plays out as expected. The mapped levels point to potential moves into the $90-100 range, based on proportional extensions from the current Primary Wave 3 framework. These aren’t random numbers—they’re calculated directly from the wave relationships visible on the chart.

What makes this setup particularly noteworthy is silver’s historical context. The metal spent years grinding sideways in consolidation, so seeing this kind of impulsive breakout represents a real shift in market character. Sure, there’ll be pullbacks along the way—that’s just how markets work—but the underlying Elliott Wave structure suggests silver is firmly in bullish territory. As long as the broader trend framework holds together, momentum favors more upside ahead.

My Take: Silver’s technical setup looks compelling here. The Elliott Wave structure is textbook bullish, and momentum indicators are aligned. If Primary Wave 3 continues developing, we could see significant gains toward those upper targets before any meaningful correction arrives.

Source: BraVoCycles Newsletter