Silver Crashes Over 10% as $80+ Rally Triggers Classic Supply Response

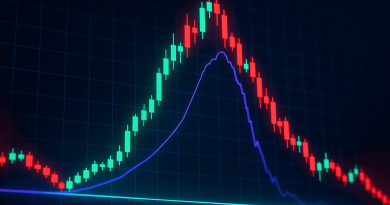

- Silver (XAG) just experienced a brutal reversal after an impressive multi-month rally pushed prices above $80. The metal gave back over 10% in a single session, dropping back into the low $70s. The chart shows what many traders call a classic parabolic move—prices climbing at an accelerating rate before suddenly breaking down. This wasn’t just a normal pullback; it was a sharp correction that caught many off guard after such a strong run.

- Here’s where it gets interesting. When Silver prices jump like this, something predictable happens: more supply hits the market. Holders start melting down coins, stored reserves get released, and mining operations ramp up production to take advantage of higher prices. It’s a feedback loop that’s been playing out for over a century.

When the price of Silver rises significantly, more holders are incentivized to sell metal into the market, including melting coins and releasing stored supply.

- This supply response is what creates Silver’s notorious boom-and-bust cycles. Prices rally hard, supply floods in, momentum stalls, and then prices correct—sometimes violently. The latest move fits this pattern perfectly. The chart shows an upward-curving trend that looked unstoppable until it wasn’t. That’s how Silver works: it’s reactive, volatile, and prone to sudden reversals when supply dynamics shift.

- Silver remains one of the most reactive commodity markets out there. It serves dual roles as both an industrial metal and a monetary asset, which adds to its complexity. When price momentum builds, it can run fast—but that same strength often sows the seeds of its own reversal by bringing more supply online.

My Take: This pullback is textbook Silver behavior. The parabolic move was unsustainable, and the supply response was inevitable. Traders should watch how XAG handles support in the low $70s—if it holds, bulls might get another shot.

Source: IncomeSharks