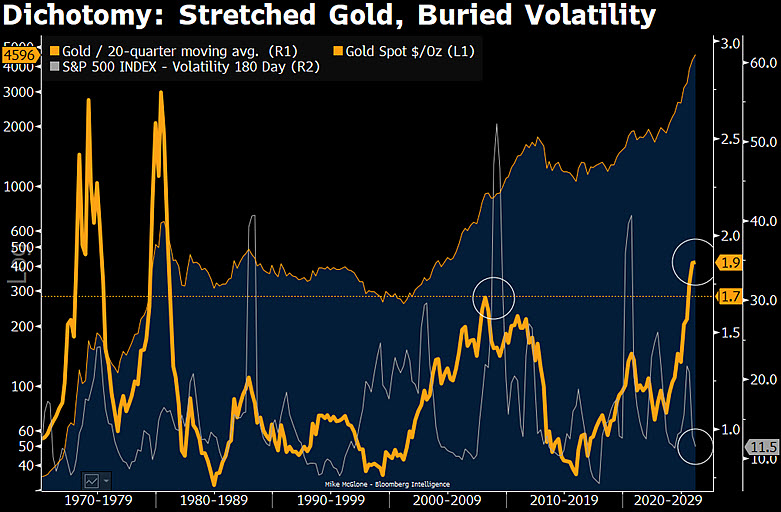

Gold Hits 1980-Level Extremes While Stock Volatility Stays Near Record Lows

Gold prices are sending one of the strongest warning signals seen in decades. The metal is currently trading at roughly 1.9 times its 20-quarter moving average, marking the most extreme deviation from its long-term trend since 1980. At the same time, equity markets remain strikingly calm, with stock volatility sitting near historic lows.

This unusual combination highlights a growing disconnect between traditional safe-haven behavior and equity risk perception, raising questions about how long such conditions can persist.

Key Market Signals

Gold Price Extremes

Gold’s current valuation represents a rare historical outlier:

- Trading at 1.9x its 20-quarter moving average

- The largest stretch above trend in more than 40 years

- Comparable extremes previously appeared only during periods of major economic stress

Historically, gold does not remain this extended without an underlying macro catalyst.

Equity Volatility Remains Suppressed

In contrast to gold’s warning signal:

- Long-term stock market volatility measures remain near cycle lows

- Equity markets show little sign of fear or stress

- Risk assets continue to price in stability rather than disruption

This calm stands in sharp contrast to gold’s aggressive move.

Why This Divergence Matters

Gold has long acted as a barometer of macroeconomic stress, monetary risk, and long-term uncertainty. When gold prices surge far above historical norms, it typically coincides with:

- Rising equity volatility

- Economic slowdowns

- Financial system stress

Since the Global Financial Crisis, episodes of elevated gold prices have usually aligned with higher market volatility—not the unusually quiet conditions seen today. The current gap between “hot” gold prices and “cold” volatility readings is among the widest observed in over four decades.

What History Suggests

Past market cycles show that such divergences rarely persist. When gold signals danger while equities remain calm, the two eventually realign. Historically, that alignment has occurred in one of three ways:

- Gold prices cool off

- Stock market volatility rises sharply

- Both adjust simultaneously

The key uncertainty is not if the gap closes, but how and when.

Outlook Toward 2026

The resolution of this disconnect could shape market conditions heading into 2026:

- A volatility spike could force a rapid repricing of risk assets

- A gold pullback could signal that macro fears were overstated

- A synchronized move could amplify market swings across asset classes

With gold near multidecade extremes, any adjustment is likely to be fast and disruptive, rather than gradual.

Source: Haider