Gold Hits 10-Year Peak While Stock Volatility Stays Low: Is a Major Market Shift Coming?

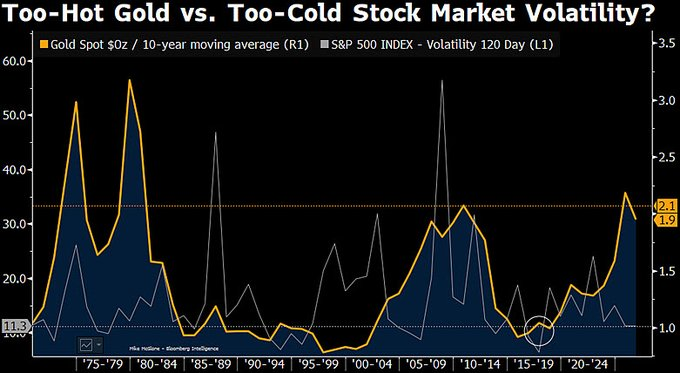

Gold prices have surged to their most stretched levels in more than a decade, trading far above long-term averages just as U.S. stock market volatility remains unusually subdued. The divergence highlights growing imbalances across financial markets at a time when macroeconomic risks are quietly building.

According to market data tracking gold’s relationship to its 10-year moving average, the precious metal is now at one of its most extreme deviations in recent history. Similar conditions in past cycles have tended to coincide with major inflection points rather than stable, long-lasting trends.

At the same time, equity markets are sending the opposite signal. Volatility in the S&P 500 remains near multi-year lows, suggesting investor complacency despite persistent uncertainty around interest rates, inflation, and global growth.

This combination — a parabolic move in gold alongside compressed equity volatility — has historically preceded sharp shifts in asset performance, volatility regimes, and risk pricing.

The analysis reflects market observations and historical pattern comparisons shared by Bloomberg Intelligence strategist Mike McGlone.

Gold’s Parabolic Move

Recent data highlights how extreme gold’s current position has become. When spot prices are compared to the 10-year moving average, gold stands at one of its most stretched levels in decades. This type of move has historically coincided with major turning points rather than stable long-term trends.

Past cycles show that when gold reaches these elevated levels, price action often marks peaks that can persist for years—not just short-term corrections lasting a few months.

Equity Volatility Remains Suppressed

In contrast, equity markets tell a very different story. The S&P 500’s 120-day volatility remains near historical lows, suggesting investor complacency despite rising macro uncertainty. This disconnect between soaring gold prices and subdued equity volatility is unusual and has often preceded broader shifts in market behavior.

Precious Metals Balances Begin to Shift

Gold and silver were operating in supply deficits not long ago. However, sharp price increases tend to alter those dynamics quickly. Elevated prices incentivize production while simultaneously cooling demand. Over time, this process can flip markets from deficit to surplus.

Historically, extreme price spikes in precious metals have often led to long periods of consolidation or underperformance as supply-demand balances normalize.

Supply, demand, and price ultimately drive commodity markets, and extreme price spikes tend to shift those balances. Gold and silver were previously in deficit, but sharp moves higher can eventually lead to excess supply and reduced demand.

Oversupply Across Multiple Asset Classes

The pattern extends beyond precious metals. Bitcoin has already experienced a similar “highz high prices cured high prices” cycle, where elevated valuations eventually weighed on demand.

Energy markets remain heavily oversupplied following the 2022 surge, with crude oil, natural gas, and gasoline still trading well above long-term anchors. Agricultural commodities such as corn, soybeans, and wheat are also dealing with excess inventories after previous price spikes.

Across commodities, the same theme is emerging: elevated prices are gradually correcting through oversupply and softer demand.

Why This Matters

Historically, a parabolic rise in gold combined with unusually low stock market volatility has signaled major shifts in asset performance and volatility regimes. These conditions often precede changes in leadership between asset classes and sharp adjustments in risk pricing.

While many investors expect U.S. equities to continue grinding higher, any normalization in volatility could dramatically reshape returns across metals, commodities, and financial assets as markets move toward 2026.

Outlook for 2026

If historical patterns hold:

- Gold’s extreme deviation from long-term averages may mark a multi-year peak rather than the start of a sustained breakout.

- Equity volatility is unlikely to remain suppressed indefinitely.

- A volatility rebound could trigger rapid repricing across asset classes, catching complacent markets off guard.

Price extremes rarely resolve smoothly. When they unwind, the process is often fast and disruptive.

Analyst Perspective

The divergence between gold’s parabolic rise and compressed equity volatility strongly suggests a regime change ahead. Markets do not stay this imbalanced for long. Once volatility returns, the adjustment across assets could be swift, broad, and unexpected.