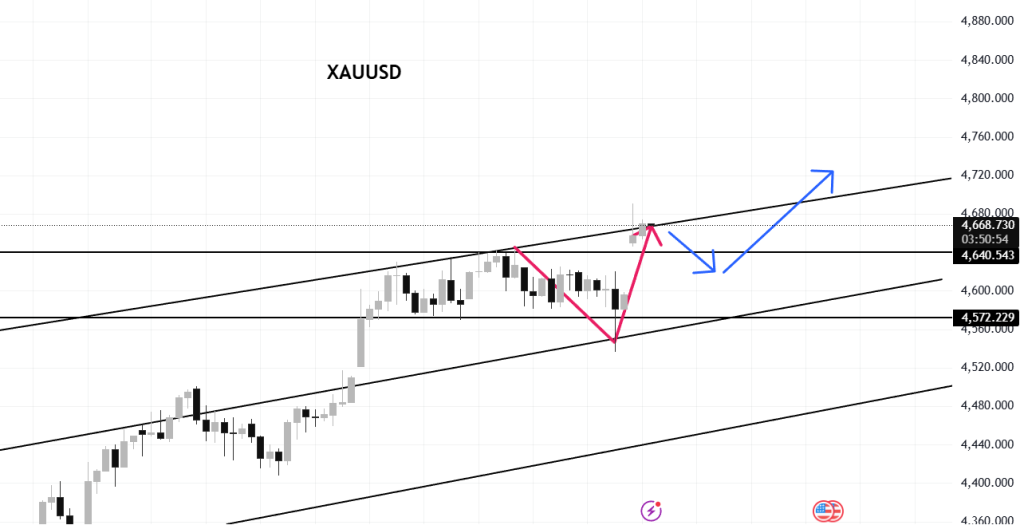

Gold Eyes $4,720 as Support Holds at $4,650 Amid Geopolitical Tensions

Gold continues to trade with a strong bullish bias as prices hold above the key $4,650–$4,660 support zone. Market participants remain focused on rising geopolitical tensions and renewed trade tariff concerns, which are reinforcing gold’s role as a safe-haven asset. Current price action suggests the broader uptrend remains intact despite recent pullbacks.

Key Market Structure and Technical Levels

Short-Term Price Action

According to market analysis shared by Shirley, gold’s short-term trend remains decisively bullish. The metal is trading within a clearly defined upward channel, indicating that recent declines represent corrective moves rather than a reversal. Price behavior shows consistent buying interest on dips, with sellers failing to establish a sustained breakdown.

Support and Resistance Levels

- Key support: $4,650–$4,660

This zone aligns with prior consolidation areas and trendline support, making it critical for maintaining bullish structure. - Upside targets: $4,690–$4,720

These levels coincide with the upper boundary of the rising channel and previous price highs.

Holding above support keeps downside risks limited and preserves the broader bullish setup.

Why This Matters

Gold’s resilience above support highlights how markets are pricing ongoing uncertainty rather than short-lived headlines. Escalating geopolitical risks and concerns over U.S. trade policy-linked tariffs continue to underpin demand for defensive assets. From a technical standpoint, the inability of sellers to break support reinforces confidence in the prevailing uptrend.

For traders and investors, this environment favors buying pullbacks rather than anticipating trend exhaustion, especially while macro risks remain elevated.

Outlook and Price Forecast

As long as gold holds above the $4,650 level, the path of least resistance remains to the upside. The current structure suggests a potential brief dip followed by renewed strength, consistent with trend continuation patterns. A sustained move toward the $4,720 area appears likely if geopolitical uncertainty persists and risk sentiment remains fragile.

A decisive break below support would be required to materially shift market sentiment.

My Take

Gold’s setup remains technically sound, with clearly defined support and resistance zones. The $4,650 area is the pivotal level to watch—holding above it keeps the bullish case intact and supports a move toward $4,720. With trade tensions and geopolitical uncertainty unresolved, gold remains well-positioned as a defensive asset.

Source:

- Technical analysis commentary from Shirley (Twitter)

- Market price structure and trend channel analysis