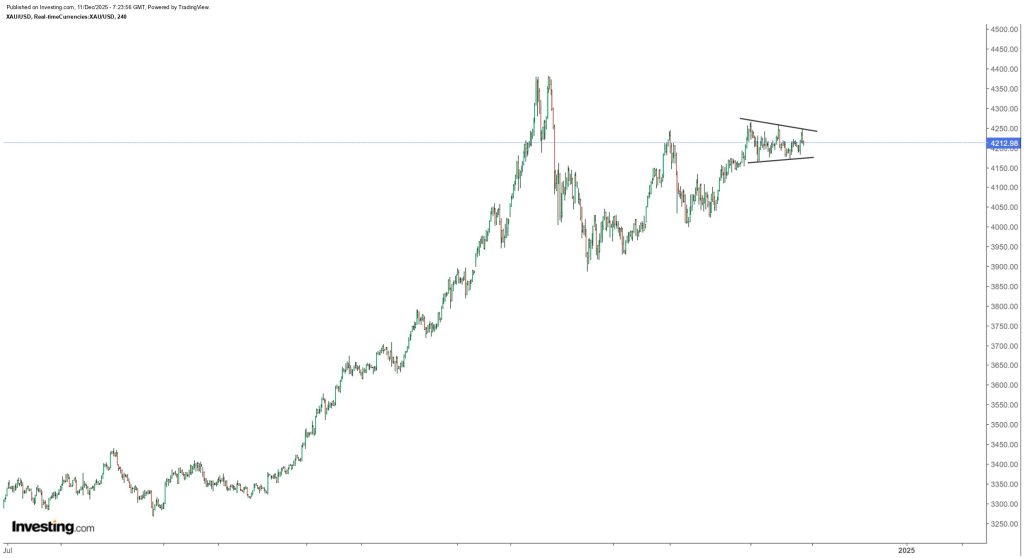

Gold Consolidates at 4200 USD Before Major Move

- Gold continues to move within a consolidation structure, remaining “not eager to breakout” despite maintaining its broader upward trajectory. The chart of XAUUSD shows a clear contracting range forming near the 4200 USD area, where price has produced a sequence of lower highs and higher lows, compressing volatility and signaling that a decisive move is approaching.

- Market expectations suggest that the current pause is a structural reset rather than a trend reversal. The accompanying chart reinforces this view by illustrating how gold has sustained a multi-year advance, capturing an extended upward trend followed by the development of a symmetrical consolidation pattern. Historically, such formations appear when markets temporarily stabilize after strong directional rallies, allowing momentum indicators and order flow to recalibrate before the next expansion phase.

Once it does, I think it is headed straight to all time high

- The current pattern reflects this behavior, showing price clustering tightly within a narrowing range that often precedes a breakout. Broader context suggests that gold’s consolidation is occurring amid elevated macroeconomic uncertainty, where demand for defensive assets typically strengthens. With inflation dynamics, rate expectations, and global geopolitical factors influencing risk sentiment, gold’s position within a mature compression zone highlights its role as a stabilizing asset while market participants await clearer catalysts.

- The chart’s formation illustrates how price remains well above prior structural supports, reinforcing the resilience of the long term trend. Expert commentary frames the current consolidation not as weakness but as a healthy preparatory stage before gold attempts new highs. As market attention concentrates on the breakout from this tightening formation, gold price news and forward looking outlooks increasingly emphasize the potential for XAU to accelerate once the range resolves, aligning technical structure with long term bullish expectations.

My Take: Gold’s consolidation at 4200 USD looks like a classic coiling pattern before the next leg up. The technical setup is clean, and with macro uncertainty still running hot, this pause feels more like preparation than exhaustion. Once we see volume pick up and a clean break, new all time highs seem very likely.

Source: Rashad Hajiyev