Tech Stock Earnings Surge 550% Since 2009 as AI Boom Accelerates

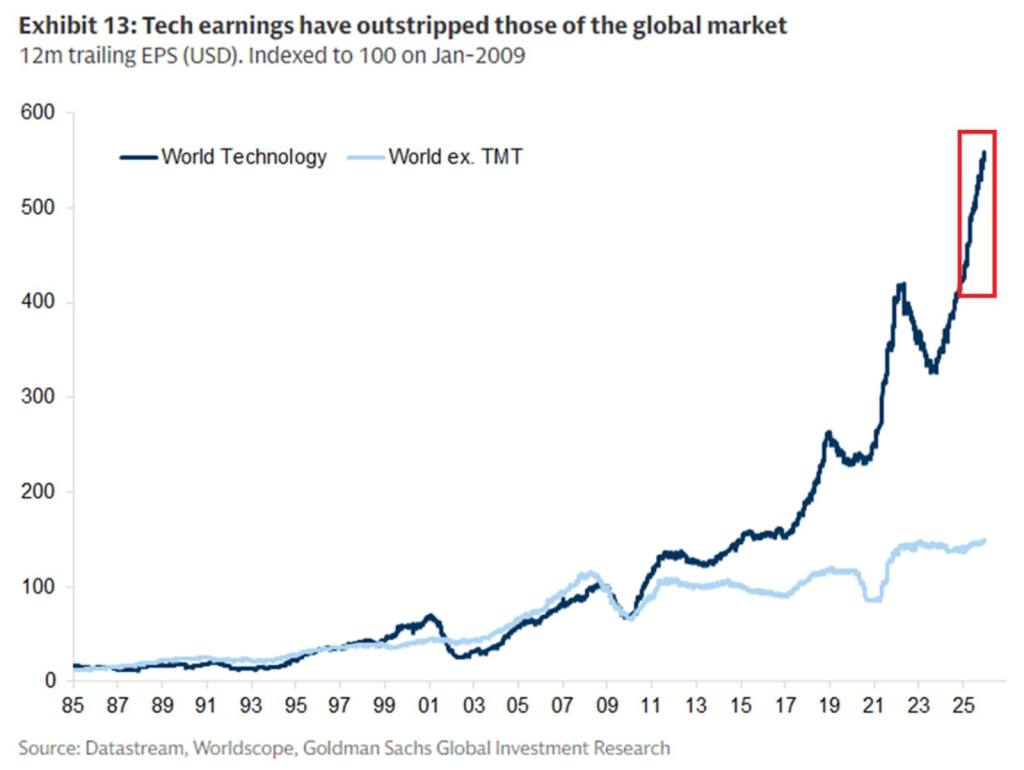

- Global technology stocks are absolutely crushing it when it comes to earnings performance, leaving the rest of the market in the dust. New analysis reveals that 12-month trailing earnings for world technology stocks have jumped more than 550% since January 2009. That’s a massive testament to how digital transformation and the recent AI explosion have reshaped the business landscape.

- What’s even more striking is that global tech companies have managed to double their net income over just the past four years. This happened despite market turbulence and tighter financial conditions that would normally slow things down. Meanwhile, earnings for global stocks excluding technology have only climbed around 50% since 2009.

The profitability of world technology stocks has grown around 11 times faster than the rest of the global market.

- Do the math, and you’ll see tech’s profitability has grown roughly 11 times faster than everything else in the global market. The gap between tech and non-tech earnings keeps widening, and recent years have seen that divide hit record levels. Technology has essentially become the profit engine driving global equity markets forward.

- Because sustained profit growth is what fuels long-term stock performance. The data makes it clear that the AI revolution and ongoing digitalization are completely reshaping which companies lead global markets. Tech firms now account for a bigger slice of worldwide corporate income than ever before. As long as AI investment keeps expanding and demand for digital infrastructure stays strong, technology’s earnings advantage will likely continue defining where global markets are headed.

My Take: This isn’t just about tech doing well—it’s about tech redefining what “doing well” means. An 11x earnings growth advantage over 16 years is staggering and suggests we’re witnessing a fundamental shift in how value gets created globally.

Source: The Kobeissi Letter