ChatGPT Could Reach 2.6 Billion Users by 2030 — But Low ARPU Highlights Monetization Risk

OpenAI forecasts that ChatGPT could reach approximately 2.6 billion weekly users by 2030, positioning it among the largest digital platforms ever built. While the scale is remarkable, the underlying economics reveal a more cautious reality. Nearly 90% of ChatGPT’s current users are located outside the US and Canada, where advertising and commerce monetization remain structurally weaker.

This gap between global adoption and revenue efficiency defines the core financial challenge facing OpenAI over the next decade.

Key Growth and Revenue Projections

Global User Expansion

ChatGPT’s growth trajectory is driven primarily by emerging markets, with countries such as India and Brazil expected to account for a disproportionate share of new users. These regions offer massive addressable audiences but significantly lower monetization potential compared to North America.

This mirrors patterns seen across major digital platforms, where international expansion delivers scale but compresses average revenue per user.

Revenue Outlook and ARPU Reality

OpenAI projects:

- $112 billion in cumulative non-subscription revenue from free users by 2030

- $46 billion in non-subscription revenue in 2030 alone

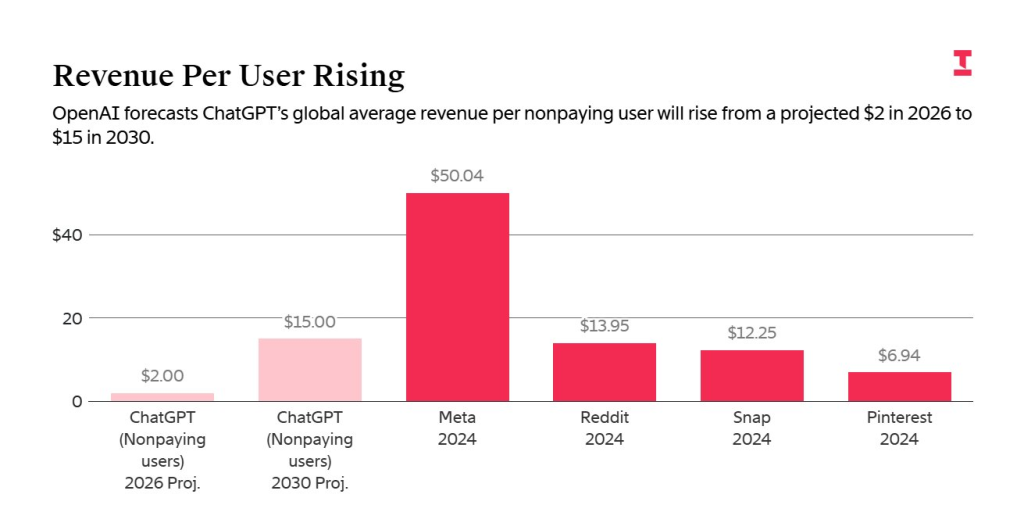

Despite these figures, average revenue per user (ARPU) remains modest:

- $2 per non-paying user in 2026

- Rising to $15 per user by 2030

For context:

- Meta generates roughly $50 ARPU

- Reddit earns $13.95

- Snap averages $12.25

- Pinterest delivers $6.94 per user (2024)

ChatGPT’s projected ARPU underscores how difficult it is to monetize global AI usage at parity with established US-centric platforms.

Why Monetization Matters More Than Scale

The central strategic issue for OpenAI is not adoption, but monetization efficiency. Advertising yields in emerging markets remain far below US levels, and AI-enabled commerce is still in early stages outside developed economies.

This creates a structural tension:

- Massive global user base

- Relatively low revenue contribution per user

Even platforms with mature ad ecosystems, such as Meta, have struggled to close this gap. For OpenAI, the challenge is amplified by the need to balance user trust, product utility, and monetization within an AI-first interface.

Industry Implications

ChatGPT’s projected growth reinforces a broader industry lesson:

Scale does not automatically translate into profitability.

Regional economics, advertiser demand, and purchasing power ultimately determine revenue outcomes. As OpenAI expands advertising products and AI-driven commerce tools, its long-term financial performance will hinge on whether these offerings can meaningfully raise global ARPU without compromising user experience.

This dynamic will be closely watched by investors tracking AI platform economics, particularly as comparisons to Meta, Alphabet, and other large-scale digital ecosystems intensify.

Outlook Through 2030

Looking ahead:

- User growth is expected to remain strongest in emerging markets

- ARPU expansion will depend on improved ad formats, localized commerce, and AI-native monetization models

- The revenue gap between global users and North America is likely to persist

Successfully converting billions of international users into sustainable revenue streams remains the defining test for OpenAI’s business model over the next five years.

Commentary

ChatGPT’s trajectory resembles earlier global expansion phases of Netflix and Spotify: enormous international audiences paired with significantly lower per-user revenue. The projected $2 ARPU baseline reflects economic reality rather than product weakness.

Ultimately, ChatGPT may become the most widely used AI platform in history — but whether it becomes one of the most profitable will depend on how effectively OpenAI solves the monetization puzzle at global scale.

Source: Chubby