ORCL Stock News: Oracle Shares Jump 7% but Technical Damage Remains

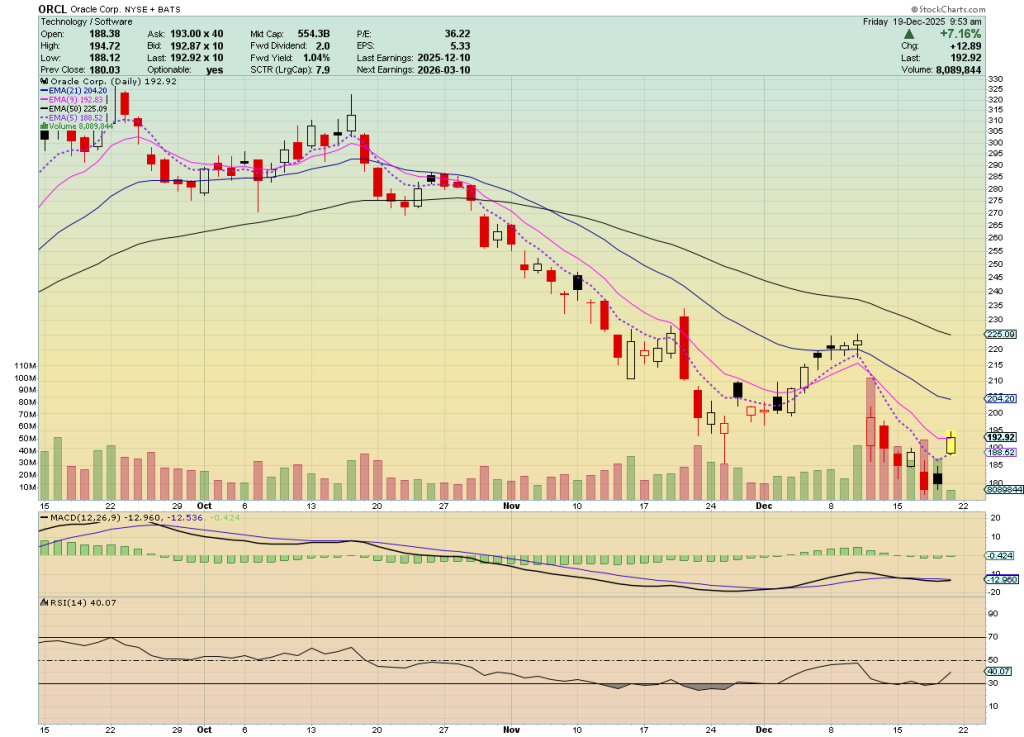

Oracle Corp. (ORCL) rallied roughly 7% to around $192–$193 in a single session—a solid percentage move that nonetheless barely registers on the longer-term chart. The bounce follows a brutal selloff that dragged shares from the $300 range down to the high-$180s, leaving the stock well below critical technical markers.

Even after the surge, ORCL sits beneath its 50-day, 100-day, and 200-day moving averages. The 200-day line, hovering near $220, acts as a ceiling the stock hasn’t challenged. Volume picked up during the rally, showing renewed interest, but not enough to flip the broader downtrend.

The Relative Strength Index is stuck in the low-40s—no longer deeply oversold, but far from bullish territory. The MACD remains negative, though the histogram shows downside pressure easing. Price action still traces lower highs and lower lows, a classic pattern of ongoing weakness.

“Despite the sharp rebound, the stock remains below key long-term indicators.”

What stands out is how much ground Oracle needs to recover before the technical picture improves. A 7% pop would normally signal a turning point, but here it looks more like a relief rally within a continuing correction. Whether this bounce turns into consolidation or fades depends on how ORCL behaves around the $200 mark and those long-term moving averages.

My Take: Oracle’s 7% jump is impressive on paper but changes little structurally. The stock is still deep in corrective territory with heavy overhead resistance. Until it reclaims at least the 200-day average, this looks like noise within a downtrend, not a reversal.

Source: Fund.Therapeutics.Photonics & $LPTH