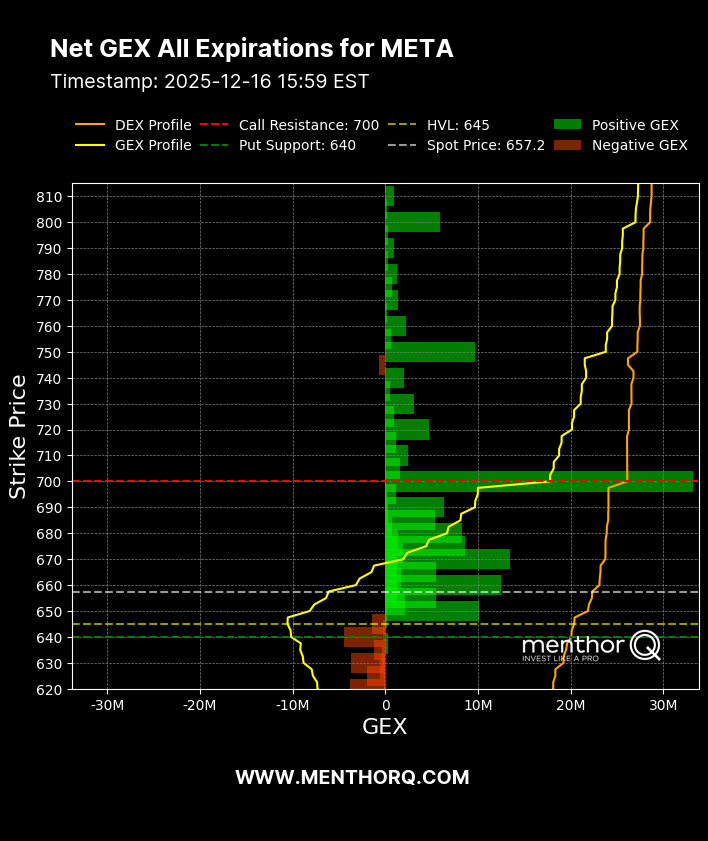

META Hovers Near Critical $657 Gamma Zone as Options Signal Rising Volatility

Meta Platforms finds itself in a technically tricky spot right now. The stock is hovering around some important options-related gamma levels that could make things interesting in the short term. META is trading dangerously close to zones where options positioning might start pushing prices around. The chart breaks down net gamma exposure across all expiration dates, showing how derivatives traders are positioned rather than pointing to any specific company news.

The numbers tell us META is sitting around $657, with a worrying zone starting just below $645. “Below this threshold, hedging dynamics tied to options positioning could amplify downside moves if the stock breaks lower,” the analysis warns. Think of it as a pressure point where the stock could become more sensitive to selling. If META dips below that $645 mark, options dealers hedging their positions might actually accelerate the decline.

Looking up, there’s significant resistance waiting at the $700 level. Heavy call gamma concentrated there means any rally toward that number could hit a wall. Basically, as the stock climbs toward $700, options hedging activity picks up and can slow down or even stop the advance. Between these two boundaries, the gamma setup looks messy, which usually translates to choppy trading without clear direction.

Why should the broader market care? Meta isn’t just another tech stock—it’s a heavyweight with serious index influence. When gamma dynamics start pushing META around, it doesn’t happen in isolation. The volatility can ripple through tech benchmarks and related stocks. Right now, with the stock sandwiched between clear support and resistance zones defined by options positioning, we could see sharp moves if either level breaks. It’s a reminder that derivatives positioning isn’t just background noise—it actively shapes how major stocks trade day to day.

My Take: Meta’s gamma squeeze potential cuts both ways here. Break below $645 and we could see accelerated selling as dealers hedge. Push through $700 and suddenly that resistance becomes rocket fuel. The $645-$700 range is your battlefield for the next move.

Source: Menthor Q