HIMS Stock News: Institutions Increase Stakes on Dip

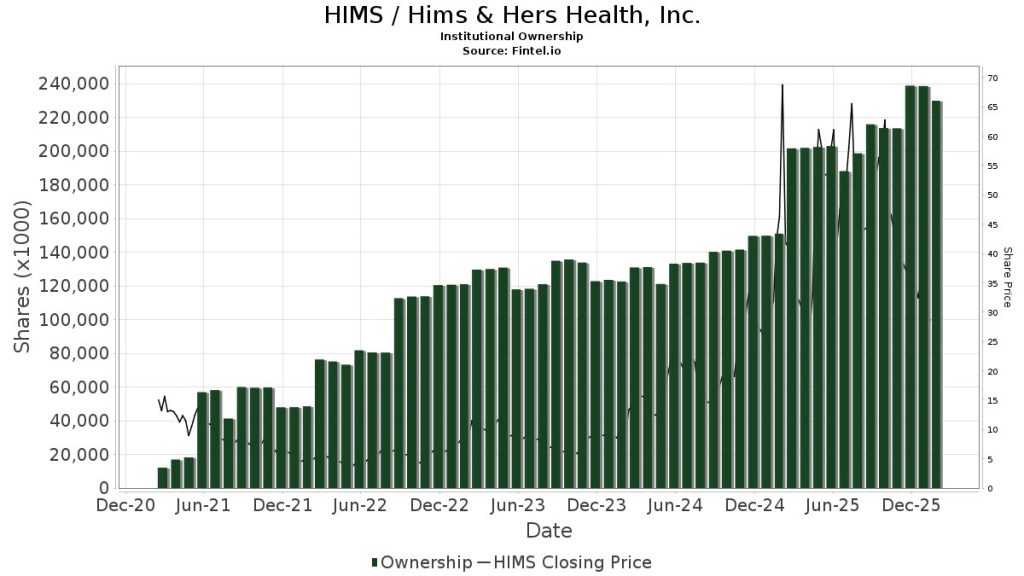

HIMS stock has shown a notable divergence between price action and ownership trends. While the share price experienced periods of decline, institutional investors steadily increased their positions. This contrast suggests that larger market participants may be viewing recent weakness as an opportunity rather than a warning sign.

The data, highlighted by market commentator The Long Investor, shows a clear upward trend in institutional shares held even as the stock moved lower during certain stretches.

Institutional Accumulation vs Retail Selling

Ownership Trend

Recent data reveals that institutional ownership in Hims & Hers Health has continued to rise despite share price pullbacks. The chart referenced in the commentary illustrates:

- A steady increase in institutional shares held

- Declining or volatile price action during the same period

- A visible disconnect between ownership behavior and short-term market sentiment

This divergence indicates that institutions were accumulating shares while retail investors reduced exposure.

Retail vs “Smart Money” Positioning

The implication is clear: individual investors responded to price weakness by selling, while larger funds increased their exposure.

This dynamic often reflects differences in time horizon and strategy. Retail traders may react to short-term volatility, whereas institutional investors typically operate with multi-year growth expectations.

Why This Matters for HIMS Stock

The divergence between falling prices and rising institutional ownership can be interpreted as a contrarian signal. Institutions generally deploy capital based on long-term structural growth prospects rather than short-term market fluctuations.

The commentary emphasizes that institutions do not operate with a three-month time horizon. Instead, they often accumulate during pullbacks, using volatility as an entry opportunity.

This approach aligns with the broader investment principle that significant returns often require enduring temporary drawdowns and buying when sentiment is weak rather than chasing momentum.

Broader Market Implications

The situation highlights a classic market dynamic:

- Short-term price declines trigger retail selling

- Institutional investors quietly build positions

- Ownership structure gradually shifts toward long-term capital

Whether this accumulation ultimately leads to sustained upside will depend on company execution, revenue growth, and broader market conditions. However, the steady increase in institutional ownership suggests confidence from large investors despite recent price weakness.

Outlook

If institutional accumulation continues, HIMS stock may find stronger support over time as long-term capital replaces shorter-term traders. However, short-term volatility could persist as sentiment stabilizes.

For investors, the key question is whether current price weakness represents a temporary dislocation—or the early stage of a longer-term re-rating.