HIMS Stock Drops Below $25 as Short Interest Surges Toward Key $18 Support

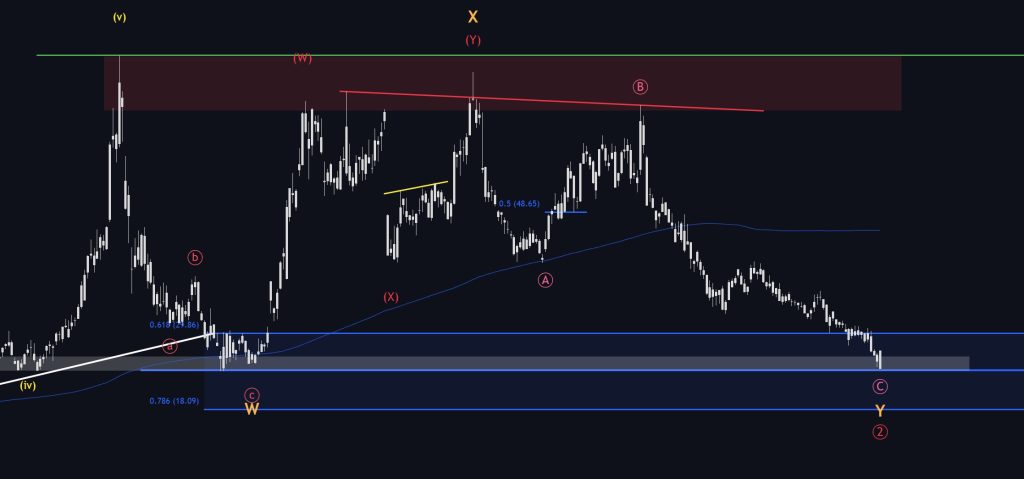

Shares of Hims & Hers Health (HIMS) have broken below the $25 level, extending a correction that began in mid-2025. The move aligns with a previously identified bearish Elliott Wave structure and places the stock within a critical support range that stretches down to $18. With short interest reaching record levels, volatility is increasing as price approaches a technically decisive zone.

Key Market Signals

Price Action and Technical Structure

The decline in HIMS has unfolded through a clear sequence of lower highs and lower lows, confirming the bearish Elliott Wave scenario outlined earlier in the correction. The breakdown below $25 marks a loss of a key psychological level and pushes the stock toward the lower boundary of its recent trading range.

Price is now compressing into a broader support area between $18 and $25. The $18 level is especially important, as it previously acted as a floor during earlier selloffs and represents the next major technical reference point.

Short Interest and Volatility Risk

Short interest in HIMS has climbed to record levels, amplifying volatility around current prices. According to the analysis, short interest is “at an absolute peak,” a condition often seen late in extended downtrends.

Historically, extreme short positioning can increase the probability of sharp moves in either direction once price reaches major support. While some speculative bullish positioning may be emerging near current levels, the chart still shows persistent weakness with no confirmed reversal pattern in place.

Why This Matters

The breakdown in HIMS reflects broader pressure across digital health and healthcare technology stocks that surged earlier in the market cycle. As one of the more visible names in the space, HIMS may act as a sentiment gauge for similar companies.

How the stock behaves within the $18–$25 support zone could influence near-term risk appetite across the sector. A stabilization here could signal exhaustion of the corrective phase, while failure would reinforce bearish momentum.

Outlook: Key Levels to Watch

The $18 support level is likely to be decisive. If buyers step in and defend this zone, the combination of extreme short interest and compressed price action could create conditions for a volatility spike or short-covering rally. However, without a clear reversal signal or volume confirmation, the prevailing trend remains bearish.

A sustained breakdown below $18 would suggest deeper downside risk and extend the correction beyond current expectations.

Sources: The Analyst