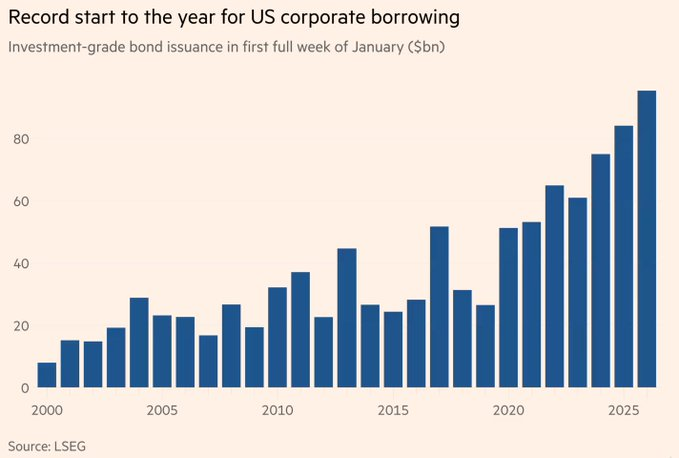

US Corporate Bond Issuance Hits $95 Billion in Record January 2026 Start

U.S. corporate borrowing surged at the start of 2026, with investment-grade bond issuance reaching $95 billion in the first full week of January, according to Financial Times data. The total, raised across 55 separate bond deals, represents the busiest start to any year on record and the largest weekly issuance since May 2020.

Key facts

- U.S. companies issued over $95 billion in investment-grade bonds during the first week of January

- The issuance involved 55 separate deals, signaling broad participation across sectors

- The volume exceeded all previous January records and marked the highest weekly total in nearly five years

- Early-January corporate bond issuance has trended higher over the past two decades, but the 2026 figure stands well above prior peaks

Market context

The surge reflects exceptionally strong investor demand for high-quality U.S. corporate debt, allowing companies to raise large sums with relative ease. Proceeds are being used to fund routine operations, AI infrastructure investments, mergers and acquisitions, and broader financing needs as government deficits continue to widen.

Deep and liquid capital markets remain one of the United States’ core financial advantages, enabling the market to absorb unusually high issuance volumes without signs of stress.

Why it matters:

- highlights the depth and resilience of U.S. capital markets

- signals strong investor appetite for investment-grade credit

- supports corporate investment in technology, expansion, and acquisitions

- increases overall corporate exposure to interest-rate and sentiment shifts

What’s next

Market participants will be watching whether elevated issuance continues through the first quarter and how sustained borrowing interacts with interest-rate expectations in 2026. Corporate debt activity is expected to remain a key indicator of financial conditions and broader economic momentum.

Source: Commentary referenced in a post by economist Mohamed A. El-Erian