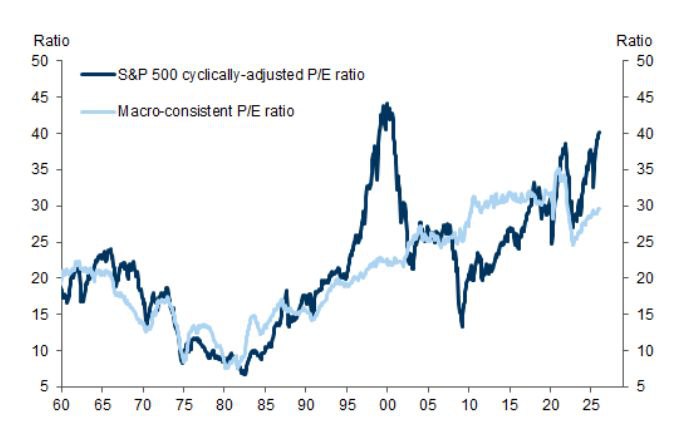

S&P 500 Valuations Approach 40x as CAPE Ratio Nears Historic Highs

Valuations for the S&P 500 are once again trending toward historically stretched levels. The cyclically adjusted price-to-earnings (CAPE) ratio is drifting back toward 40x, while the macro-consistent P/E ratio sits near 30x. Together, these measures indicate that equity markets are pricing in strong forward earnings growth, stable corporate margins, and continued macroeconomic resilience.

Although current levels have not yet reached the extremes seen during the 2000 dot-com bubble, they remain elevated by long-term historical standards.

Key Valuation Metrics

CAPE Ratio Near 40x

The CAPE ratio, which smooths earnings over an extended economic cycle, is approaching 40x. Historically, readings at or near this level have coincided with periods of heightened investor confidence and ambitious expectations for corporate profitability. While today’s valuation environment is not yet equivalent to the peak of the technology bubble, it clearly reflects optimistic pricing of future growth.

Macro-Consistent P/E Around 30x

At the same time, the macro-consistent P/E ratio is hovering near 30x. This reinforces the view that investors are assigning premium valuations to equities based on assumptions of sustained expansion, resilient margins, and limited economic disruption. The combined message from these indicators is that the market expects companies to continue delivering strong results without meaningful setbacks.

Why This Matters

At earnings multiples between 30x and 40x, the margin for error narrows considerably. In previous bull markets, expanding valuation multiples played a significant role in driving equity appreciation. Today, however, further upside appears increasingly dependent on actual earnings growth rather than additional multiple expansion.

The market dynamic is shifting toward performance validation. Companies must meet or exceed expectations to justify current pricing. If earnings growth remains strong, valuations may stabilize at elevated levels. However, if results disappoint, the adjustment may occur through multiple compression rather than gradual repricing, potentially leading to sharper corrections.

Risks at Elevated Valuations

Historically, markets trading near 40x CAPE have required exceptional earnings performance to sustain those levels. When valuations are this high, even modest earnings misses can weigh heavily on sentiment. Price sensitivity to macroeconomic developments increases, and downside volatility can accelerate if growth assumptions are revised lower.

The higher the starting multiple, the more dependent market stability becomes on flawless corporate execution.

Outlook for the S&P 500

With valuations approaching 40x on a CAPE basis, the S&P 500 sits firmly in optimistic territory. While not yet at dot-com era extremes, current pricing reflects strong confidence in corporate earnings durability and economic stability.

Looking ahead, equity performance is likely to depend less on valuation expansion and more on sustained earnings growth, margin resilience, and macro stability. At these levels, markets are effectively pricing near-perfect execution, leaving limited room for error if expectations are not met.