US Inflation Drops to 0.99% as Real-Time Data Shows Deflation Across Key Consumer Categories

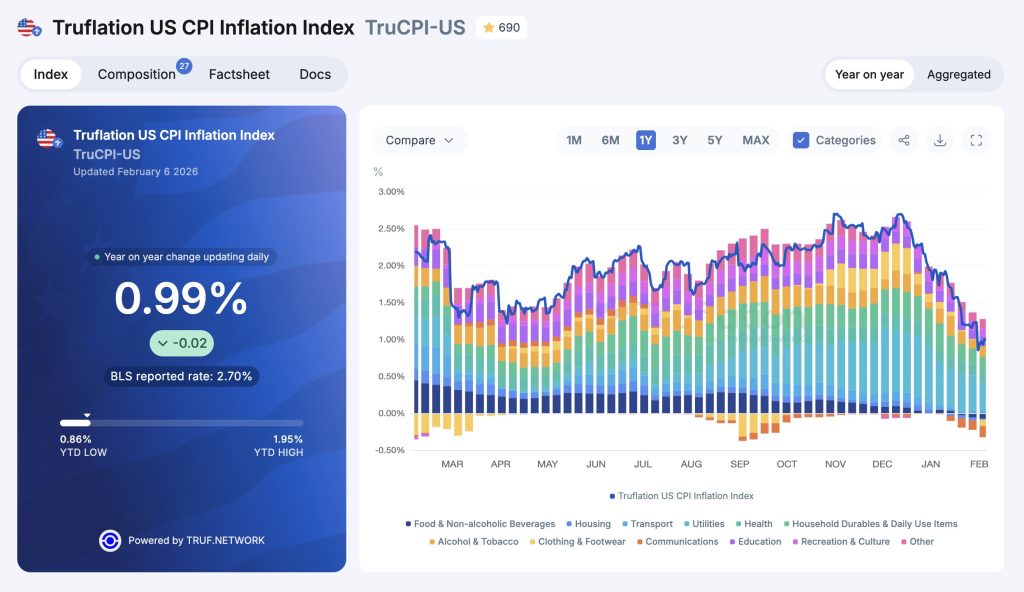

US inflation appears significantly lower when measured using real-time data rather than traditional government surveys. According to Truflation’s continuously updated US CPI Inflation Index, annual inflation currently stands at just 0.99%. This contrasts sharply with the 2.7% CPI figure published by the Bureau of Labor Statistics, creating a gap of 1.71 percentage points between the two measures.

Key Inflation Signals from Real-Time Data

Real-Time CPI vs Official Inflation

Truflation tracks inflation using live pricing data pulled from digital sources across the economy, rather than relying on monthly surveys. Its index covers consumer categories such as food, housing, transportation, utilities, healthcare, and discretionary spending.

Since early 2025, Truflation’s CPI measure has declined steadily from above 2% to below 1%, reflecting what consumers are experiencing in real time. The growing divergence suggests official CPI may be lagging behind actual price dynamics in the economy.

As noted in Truflation’s latest update, real-time inflation data indicates that US price pressures remain significantly lower than official government figures.

Deflation Emerging in Major Spending Categories

Four major consumer categories have now slipped into outright deflation on a year-over-year basis:

- Communications

- Clothing

- Food

- Housing

These deflationary trends are offsetting modest inflation in healthcare and select service sectors. As a result, the overall real-time inflation index has been pushed below the 1% level, signaling broader disinflationary pressure across essential household spending.

Why This Matters

The widening gap between real-time and official inflation metrics has important implications for markets and monetary policy. Persistent disinflation across core consumer categories may indicate weakening pricing power and a shift in economic momentum.

For investors, the divergence raises questions about whether financial markets are being priced off outdated inflation data. For policymakers, it suggests that interest rate expectations could adjust more rapidly if official CPI readings eventually converge with real-time measures.

Outlook for Inflation and Policy Expectations

As Truflation updates its inflation data daily, economists and investors are closely monitoring whether traditional CPI measurements will begin to reflect the same cooling trend. If real-time inflation remains near 1% while official figures stay above 2.5%, it could signal a structural lag in how inflation is being measured.

Such a discrepancy may accelerate changes in rate expectations faster than policymakers currently anticipate, particularly if deflation continues to spread across essential spending categories.

Sources: Truflation